Key Takeaways

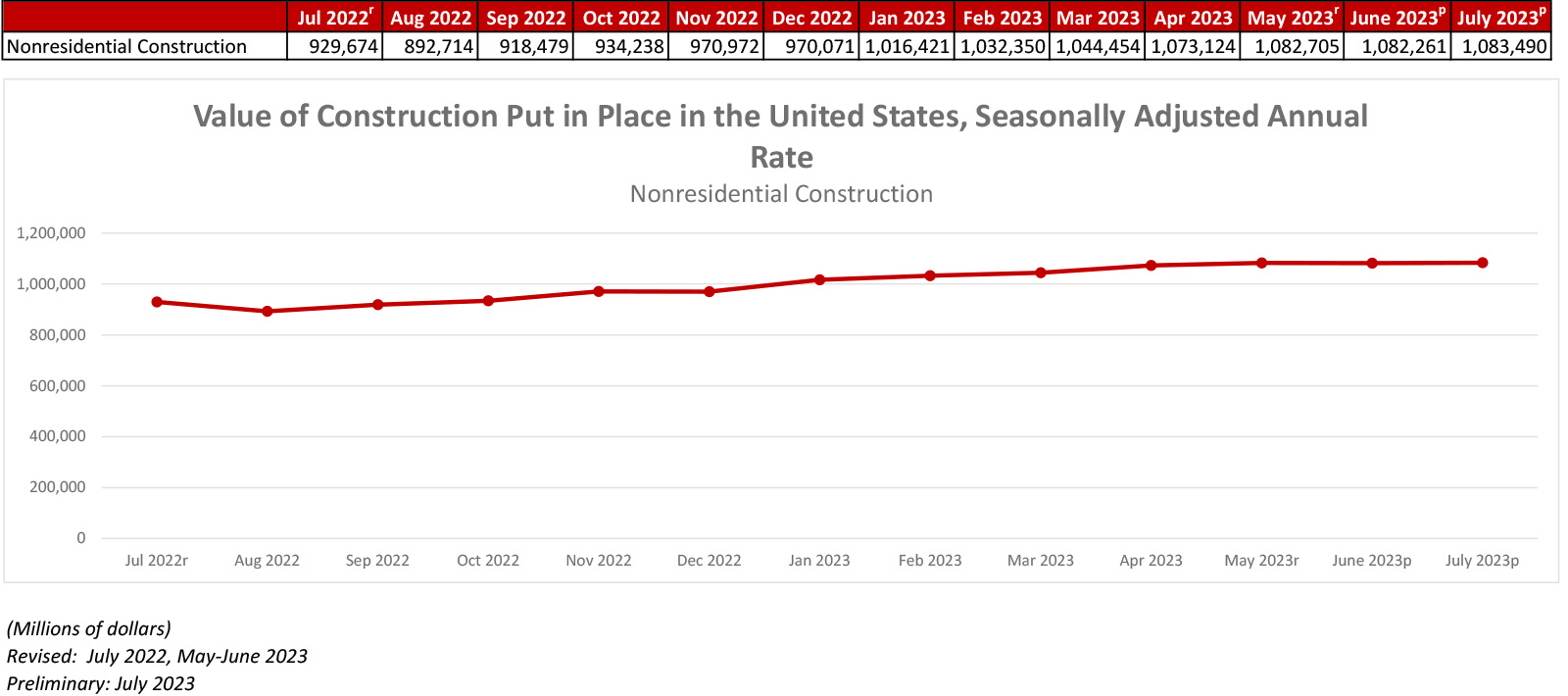

- National nonresidential construction spending increased 0.1% again in July.

- On a seasonally adjusted annualized basis, nonresidential spending totaled $1.08 trillion for the month and is up 16.5% year-over-year.

- "Spending growth should be solid going forward, driven in large measure by several massive construction projects in development or early construction stages. That said, those segments that depend most on bank financing are poised to weaken going forward."

Press Release from Associated Builders and Contractors: Nonresidential Construction Spending Increased Slightly in July, Says ABC

WASHINGTON, Sept. 1—National nonresidential construction spending grew 0.1% in July, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.08 trillion and is up 16.5% year over year.

Spending was up on a monthly basis in 8 of the 16 nonresidential subcategories. Private nonresidential spending increased 0.5%, while public nonresidential construction spending was down 0.4% in July.

"After today’s jobs report, which indicated that nonresidential construction added an outsized number of jobs in August, one would have expected a strong construction spending growth number as well," said ABC Chief Economist Anirban Basu. "Alas, the economic data, just like the economy, continue to be full of surprises. In July, nonresidential construction spending barely expanded. Once one adjusts for inflation, spending declined in real terms."

“Perhaps the bigger surprise is that construction spending weakness was not concentrated in the private developer-driven segments that have struggled to establish consistent momentum, but in a number of public construction segments," said Basu. "Monthly spending was down in the highway/street, transportation, sewage/waste disposal and conservation/development categories. However, each of these categories has experienced year-over-year spending growth."

"Since nonresidential construction hiring was strong last month, the expectation is that July’s construction spending number will prove to be an aberration," said Basu. "Spending growth should be solid going forward, driven in large measure by several massive construction projects in development or early construction stages. That said, those segments that depend most on bank financing are poised to weaken going forward."

Press Release from Associated General Contractors of America: Construction Sector Adds 22,000 Employees In August, While Spending Increases In July Despite Downturn In Major Infrastructure Categories

Construction Employment Reaches 7,993,000 amid Strong Demand for Project, Firms Boost Pay to $34.40 an Hour as They Try to Attract a Limited Pool of Qualified Workers with Sector’s Unemployment at 3.9%

The construction industry added 22,000 jobs in August, while total construction spending rose 0.7 percent in July, despite a downturn in most infrastructure investment categories, according to an analysis of new government data the Associated General Contractors of America released today. Association officials cautioned that progress on many public infrastructure projects was likely being undermined by the added layers of red tape the Biden administration continues to add for new public works efforts.

"Today’s reports show there is no letup in demand for construction workers or private-sector projects,” said Ken Simonson, the association’s chief economist. "The industry is raising pay faster than other sectors amid persistently low unemployment. But contractors are frustrated by the slow pace of new public project awards."

Construction employment in August totaled 7,993,000, seasonally adjusted, an increase of 22,000 from July and 212,000 or 2.7 percent from a year earlier. That outpaced total nonfarm job growth of 2.0 percent over 12 months. Nonresidential construction firms—nonresidential building and specialty trade contractors along with heavy and civil engineering construction firms—added 21,000 employees for the month and 169,700 (3.7 percent) since July 2022. Employment at residential building and specialty trade contractors grew by 1,400 last month and 42,400 (1.3 percent) over 12 months.

Average hourly earnings for production and nonsupervisory employees in construction—covering most onsite craft workers as well as many office workers—jumped by 5.7 percent over the year to $34.40 per hour in August. Construction firms paid a wage “premium” of 18.6 percent compared to the average hourly earnings for all private-sector production employees. However, contractors report difficulty finding qualified workers amid an unemployment rate of only 3.9 percent in August for jobseekers with construction experience.

Construction spending in July totaled $1.97 trillion at a seasonally adjusted annual rate, an increase of 0.7 percent from June and 5.5 percent from July 2022. Private residential spending climbed 1.4 percent for the month, while private nonresidential spending rose 0.5 percent. But public construction spending slid 0.4 percent as the largest infrastructure categories declined from June. Highway and street construction spending fell by 0.6 percent, transportation by 0.9 percent, and sewage and waste disposal by 1.2 percent.

Association officials noted that public construction activity has been hampered by a flurry of regulatory measures that are causing confusion and slowing approvals on projects. They noted that this week alone the administration issued new rules that will add to the confusion around what constitutes a water of the U.S. and others that seek to apply federal wage rates to projects funded by the so-called Inflation Reduction Act.

"It appears that the Biden administration can’t decide if it wants projects to get built or prefers to suffocate them with red tape," said Stephen E. Sandherr, the association’s chief executive officer. "At some point, people are going to begin wondering what happened to all those projects the administration promised would be built."