According to data released Friday by the US Bureau of Labor Statistics, the national construction industry lost 9,000 jobs on net in March.

Key Takeaways

- The construction industry lost 9,000 jobs on net in March.

- Nonresidential construction employment decreased by 1,800 positions on net, with declines in two of the three subcategories.

- "Despite a small dip in headcount, construction firms continued to post a high level of job openings and raised pay more than other industries—two signs they still want to hire more worker. But the pool of unemployed, experienced jobseekers keeps shrinking for the construction sector."

Press Release from Associated Builders and Contractors, Inc (ABC)

Construction Employment Decreases By 9,000 in March, Says ABC

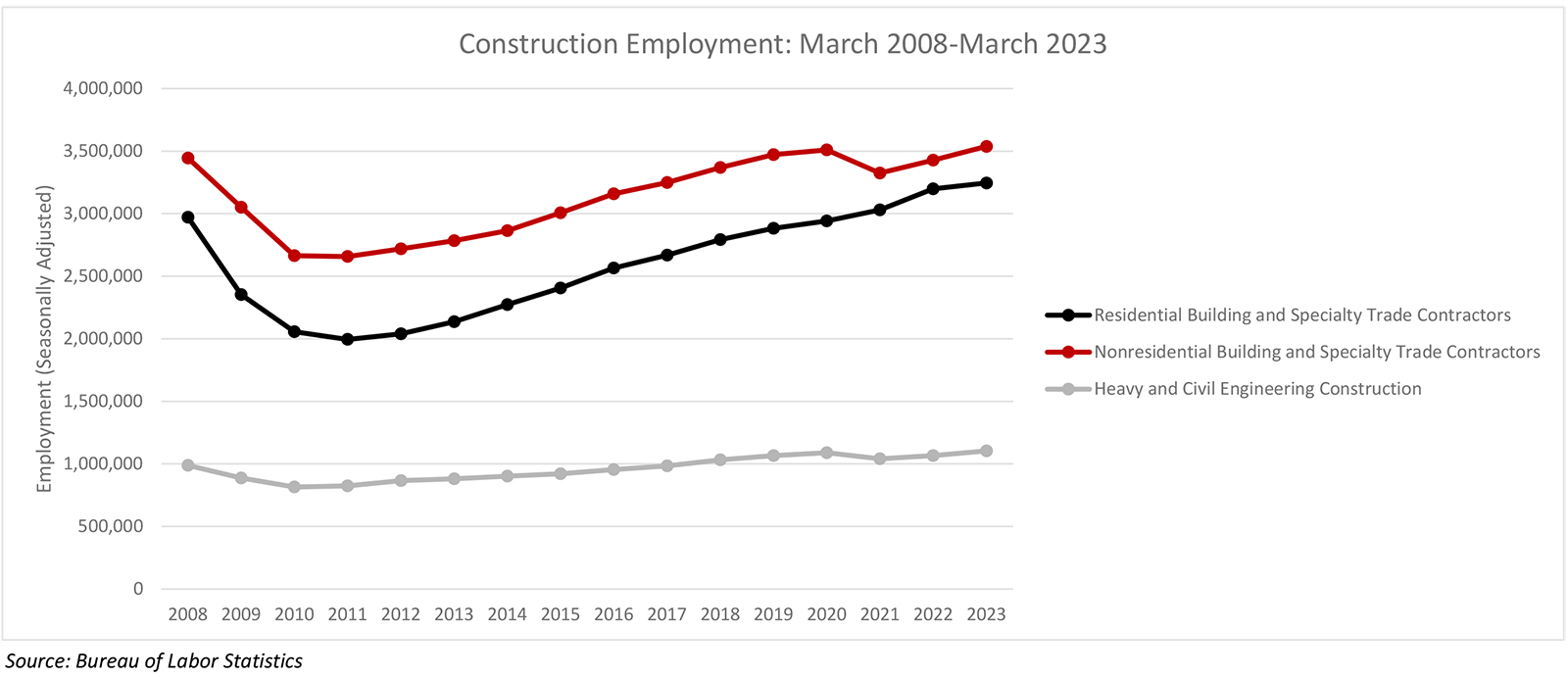

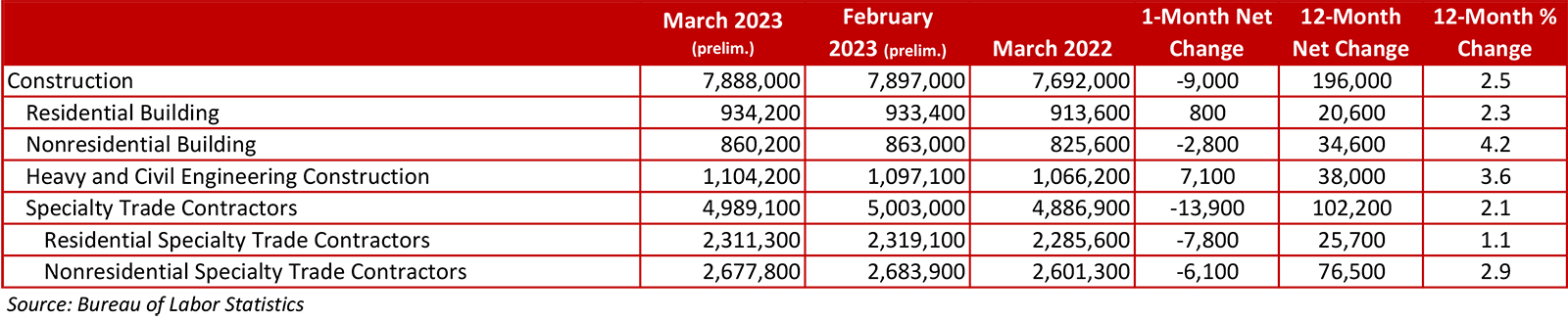

WASHINGTON, April 7—The construction industry lost 9,000 jobs on net in March, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Labor Statistics. On a year-over-year basis, industry employment has grown by 196,000 jobs, an increase of 2.5%.

Nonresidential construction employment fell by 1,800 positions on net, with declines in 2 of the 3 subcategories. Nonresidential specialty trade lost 6,100 positions, while the number of nonresidential building jobs decreased by 2,800. Heavy and civil engineering added 7,100 net new jobs.

The construction unemployment rate declined to 5.6% in March. Unemployment across all industries decreased from 3.6% in February to 3.5% last month.

"The March employment report may hint at growing economic weakness in the months to come," said ABC Chief Economist Anirban Basu. "While the nonresidential construction industry lost fewer than 2,000 jobs, the addition of jobs in publicly financed construction categories masks more substantial weakness in private segments. It is precisely those private segments that tend to be most affected by slowing economic growth, deteriorating confidence and concerns regarding the nation’s banking system."

"While the nation continues to progress economically, headwinds are building," said Basu. "Recession remains a likely outcome within the next 12 months. Contractors generally report healthy backlog and confidence regarding the next six months, but the industry may be positioned for meaningfully weaker conditions in 2024."

Press Release from Associated General Contractors of America (AGC)

Labor Shortages are Making it Harder for Firms to Replace Retiring Workers as Construction Officials Continue to Call for New Construction Education and Training Support and Immigration Reform Measures

The construction sector shed 9,000 jobs in March, the first decrease since January 2022, even as the sector’s unemployment rate fell and total number of job openings in the sector hit a near-record high, according to an analysis by the Associated General Contractors of America of new government data. Association officials said the industry was struggling to replace aging workers and pushed for new construction training and education support, as well as immigration reform measures to encourage more people into the industry.

“Despite a small dip in headcount, construction firms continued to post a high level of job openings and raised pay more than other industries—two signs they still want to hire more workers,” said Ken Simonson, the association’s chief economist. “But the pool of unemployed, experienced jobseekers keeps shrinking for the construction sector.”

Construction employment in March totaled 7,888,000, seasonally adjusted, a dip of 9,000 or 0.1 percent from the record high in February and the first decrease in 14 months. Nonresidential firms—comprising nonresidential building and specialty trade contractors along with heavy and civil engineering construction firms—shed a statistically insignificant 1,800 employees in March. Employment at residential building and specialty trade contractors slipped by 7,000 or 0.2 percent.

The unemployment rate among jobseekers with construction experienced declined from 6.0 percent in March 2022 to 5.6 percent, the second-lowest March rate in the 23-year history of the data. A separate government report released earlier this week reported that job openings in construction at the end of February totaled 384,000, just shy of the all-time high for February of 388,000.

Average hourly earnings for production and nonsupervisory employees in construction—covering most onsite craft workers as well as many office workers—jumped by 6.6 percent over the year to $33.82 per hour. Construction firms in March provided a wage “premium” of nearly 19 percent compared to the average hourly earnings for all private-sector production employees.

Association officials said federal officials have failed to boost investments in construction education and training even as they have boosted investments in a wide range of construction programs. They urged public officials at all levels to provide more support for construction programs in schools, apprenticeships, and other training programs. And they urged Congress and the Biden administration to allow more workers with construction skills to lawfully enter the country to work in the sector.

“Firms are struggling to fill high-paying construction positions while many schools continue to push students to go to college, amass student debt and hope for an office job,” said Stephen E. Sandherr, the association’s chief executive officer. “Exposing students and other future workers to construction will signal that it should be among the career paths worth considering.”