According to data released today by the US Bureau of Labor Statistics, the national construction industry added 17,000 jobs on net in December.

Key Takeaways

- The construction industry added 17,000 jobs on net in December. Year-over-year, industry employment has risen by 197,000 jobs, or an increase of 2.5%.

- Nonresidential construction employment increased by 11,900 positions on net, with growth in 2 of the 3 subcategories (nonresidential building and specialty trade construction).

- "Construction employment increased for the ninth consecutive month, with the nonresidential segment adding jobs at a particularly rapid pace."

Press Release from Associated Builders and Contractors, Inc (ABC)

ABC: Nonresidential Construction Adds Nearly 12,000 Jobs in December

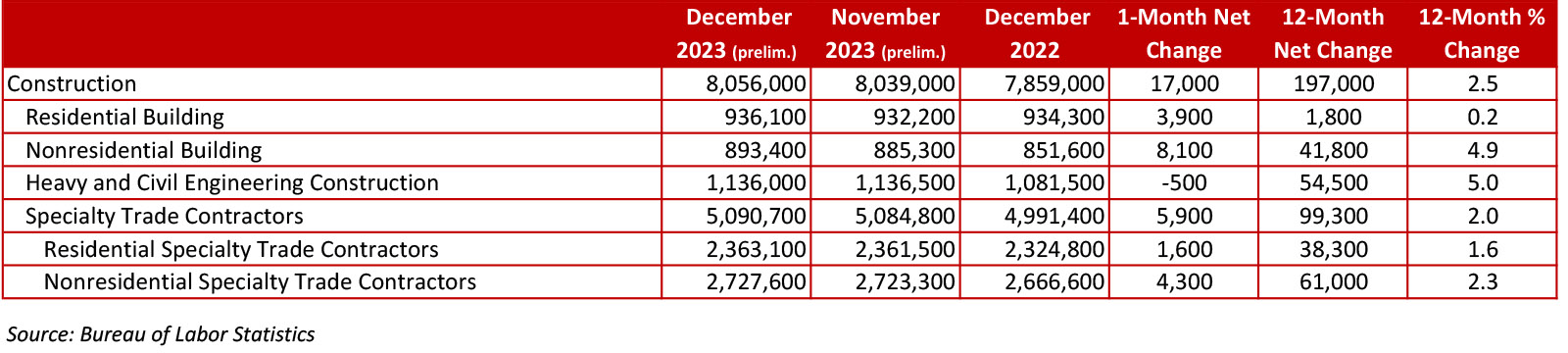

WASHINGTON, Jan. 5—The construction industry added 17,000 jobs on net in December, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Labor Statistics. On a year-over-year basis, industry employment has grown by 197,000 jobs, an increase of 2.5%.

Last month, nonresidential construction employment increased by 11,900 positions on net, with growth in 2 of the 3 subcategories. Nonresidential building added 8,100 positions, while nonresidential specialty trade added 4,300 jobs on net. Heavy and civil engineering lost 500 jobs.

The construction unemployment rate fell to 4.4% in December. Unemployment across all industries remained unchanged at 3.7% last month.

"Despite strong construction industry employment growth, today’s jobs report was highly contradictory," said ABC Chief Economist Anirban Basu. "On one hand, economywide payroll employment expanded faster than expected in December, and the unemployment rate remained unchanged at 3.7%, close to the lowest level in over a half a century. Construction employment increased for the ninth consecutive month, with the nonresidential segment adding jobs at a particularly rapid pace."

"On the other hand, the labor force shrank by 676,000 persons in December, the largest decline since early 2021," said Basu. "Wage growth also accelerated, with average hourly earnings up 4.1% year over year across all industries. That’s faster than expected and a level not consistent with a return to 2% inflation. Construction industry earnings have increased at an even faster rate over the past year. "

"This is only one month’s data and could contain significant statistical noise," said Basu. “That said, the combination of faster wage growth and a smaller labor force suggests that interest rates could remain higher for longer."

Press Release from Associated General Contractors of America (AGC)

Hourly Wages for Production Workers Climb 5.1 Percent over the Year, Outpacing Overall Private Sector; Association Survey Finds Most Contractors Plan to Add to Headcount in 2024 but Anticipate Difficulty

The construction sector added 17,000 employees in December and continued to raise wages at a faster clip than other industries, the Associated General Contractors of America reported in an analysis of government data released today. Association officials said the survey it released this week found contractors expect to hire more employees in 2024 but are struggling to find enough qualified workers.

"The above-average wages that the construction industry pays have helped contractors add workers," said Ken Simonson, the association’s chief economist. "More than two-thirds of firms in our survey say they plan to expand in 2024 but they expect it will be as hard or harder to do than it was in 2023."

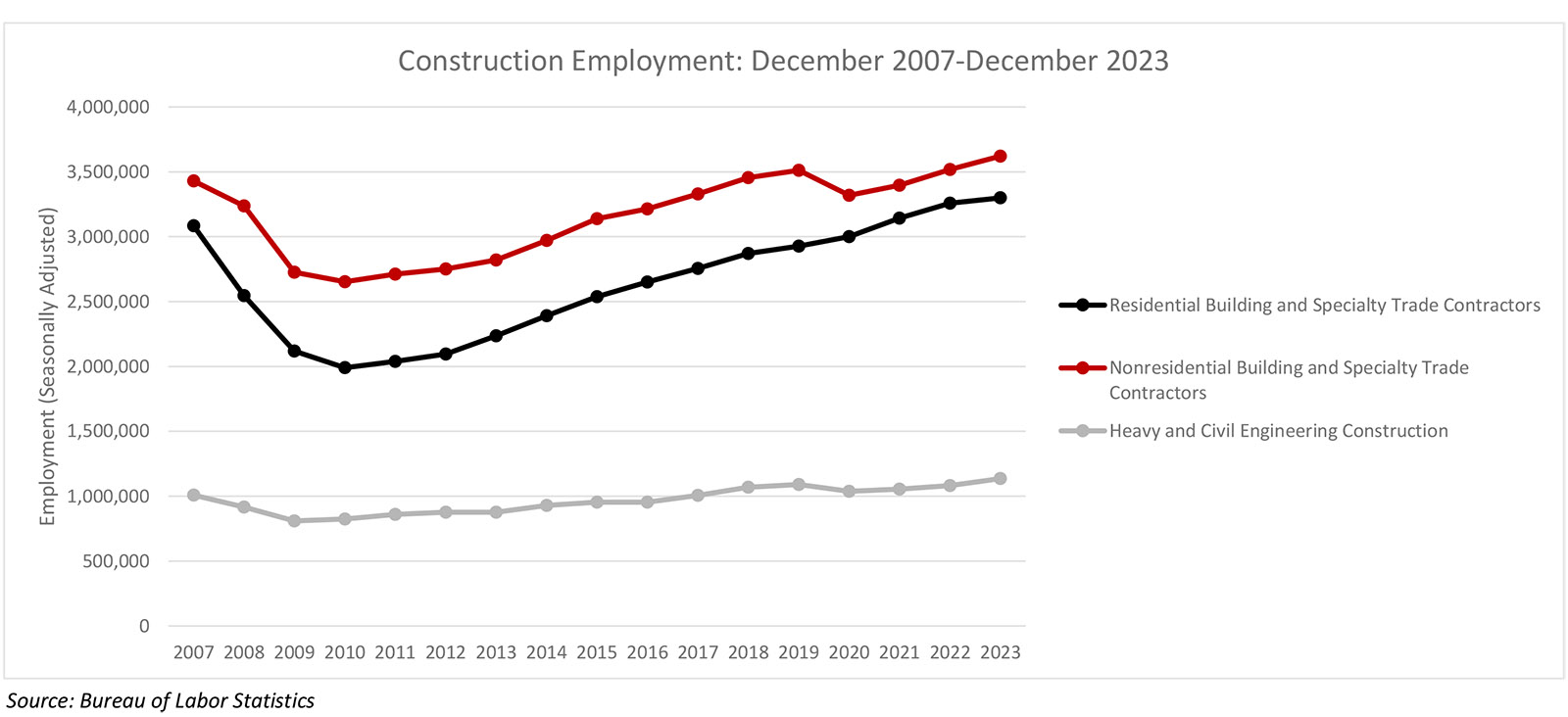

Construction employment in December totaled 8,056,000, seasonally adjusted, an increase of 17,000 from November. The sector has added 197,000 jobs during the past 12 months. That was a gain of 2.5 percent, which outpaced the 1.7 percent job growth in the overall economy. Residential building and specialty trade contractors added 5,500 employees in December and 40,100 (1.2 percent) over 12 months. Employment at nonresidential construction firms—nonresidential building and specialty trade contractors along with heavy and civil engineering construction firms—climbed by 11,900 positions for the month and 157,300 (3.4 percent) since December 2022.

Average hourly earnings for production and nonsupervisory employees in construction—covering most onsite craft workers as well as many office workers—climbed by 5.1 percent over the year to $34.92 per hour. Construction firms in December provided a wage “premium” of nearly 19 percent compared to the average hourly earnings for all private-sector production employees.

In a survey the association released on Thursday, 69 percent of the nearly 1300 responding construction firms reported they expect to add to their headcount in 2024, while only 10 percent expect to reduce headcount. But 55 percent of respondents, including both union and open-shop employers, expect it will be as hard or harder to do so than in 2023.

Association officials observed that contractors will have trouble completing the infrastructure, renewable energy, and advanced manufacturing projects the Biden administration is counting on unless they can hire enough skilled workers. They urged officials in Washington to reform employment-based immigration policies and boost funding for career and technical education programs that will enable more people to qualify for rewarding jobs in construction.

"Contractors are eager to build the structures that will sustainably improve the nation’s productivity and quality of life," said Stephen E. Sandherr, the association’s chief executive officer. "Limiting who can work in construction undercuts the sector’s ability to deliver projects on time and on budget."