Key Takeaways

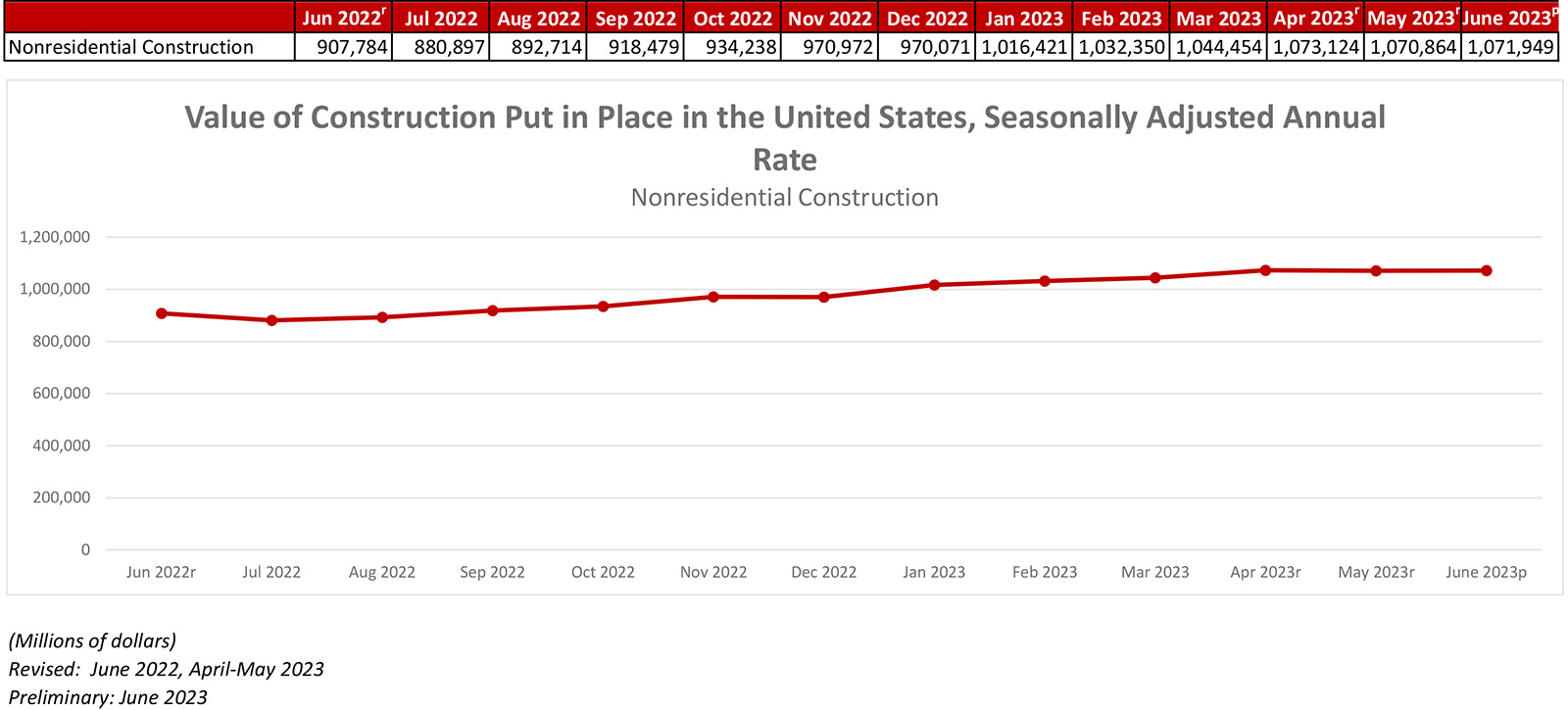

- National nonresidential construction spending increased 0.1% in June.

- On a seasonally adjusted annualized basis, nonresidential spending totaled $1.07 trillion for the month.

- "While those that focus on public work stand to remain busy for years to come, those who specialize in meeting the needs of developers of office buildings, hotels and shopping centers are likely to struggle to support backlog going forward. "

Press Release from Associated Builders and Contractors: ABC: Nonresidential Construction Spending Increases Slightly in June

WASHINGTON, Aug. 1—National nonresidential construction spending increased 0.1% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. Spending is up 18% over the past 12 months. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.07 trillion in June.

Spending increased on a monthly basis in 12 of the 16 nonresidential subcategories. Private nonresidential spending was virtually unchanged, while public nonresidential construction spending rose 0.3% in June.

“Nonresidential construction spending growth downshifted over the past two months,” said ABC Chief Economist Anirban Basu. “While stakeholders can expect ongoing spending growth in public nonresidential construction segments as more Infrastructure Investment and Jobs Act monies flow into the economy, private developer-driven activity appears to be drying up in the context of higher costs of capital and tighter credit conditions.”

“Among other things, these dynamics will translate into larger spreads in performance among contractors,” said Basu. “While those that focus on public work stand to remain busy for years to come, those who specialize in meeting the needs of developers of office buildings, hotels and shopping centers are likely to struggle to support backlog going forward. The good news is that there remain private construction segments associated with rosier prospects, including manufacturing, data centers and health care.”

Press Release from Associated General Contractors of America: Construction Spending Grows 0.5 Percent In June To An Annual Rate Of $1.94 Trillion As Demand For Residential & Nonresidential Construction Rises

Solid Gains in Commercial, Manufacturing and Office Construction Offset Declines in Power and Highway and Street Construction Between May and June as Association Officials Call on Feds to Clarify Project Regs

WASHINGTON, Aug. 1—Total construction spending increased by 0.5 percent in June driven by increases in most residential and nonresidential construction segments, according to an analysis of federal spending data the Associated General Contractors of America released today. Association officials noted that spending on highway and street projects declined for the month in June, however, warning that regulatory confusion around issues like Buy America rules were delaying activity on many projects.

“Despite high interest rates, private sector demand for most types of construction activity continues to expand,” said Stephen E. Sandherr, the association’s chief executive officer. “Ironically, demand softened in sectors like power and highway & street construction where Washington has directed significant sums.”

Construction spending, not adjusted for inflation, totaled $1.938 trillion, at a seasonally adjusted annual rate in June. That figure is 0.5 percent above the May rate, which was revised up from the initial estimate. Spending on private residential construction increased for the second consecutive month in June, by 0.9 percent. Spending on private nonresidential construction was flat in June, while public construction investment increased 0.3 percent.

Spending was mostly positive among large nonresidential segments. The biggest component, commercial construction—comprising warehouse, retail, and farm construction—increased 0.1 percent in June compared to a month ago. Spending on manufacturing plants increased 0.3 percent between May and June. Spending on office construction grew by 0.7 percent for the month. Educational construction grew by 0.1 percent compared to the prior month. However, spending on power construction fell by 1.3 percent for the month and highway and street construction fell by 0.1 percent compared to May.

Residential spending grew by 0.9 percent from May to June. Single-family homebuilding contributed the majority share of the growth, expanding by 2.1 percent for the month. New multifamily construction also was up 1.5 percent compared to May.

Association officials said the spending increases for most categories were welcome news and a sign of continued economic strength. But they warned that confusion about some of the regulatory requirements associated with the federal construction funding – including incomplete guidance on new Buy America rules – was delaying many construction projects where funding has been announced, but construction has yet to start.

“Confusion about some of the strings that come with the new federal construction funds is limiting the economic impact of these investments for now,” said Sandherr. “The sooner the administration clarifies questions around Buy America and the rules around clean energy investments, the sooner construction can begin on many infrastructure and power projects across the country.”