Key Takeaways

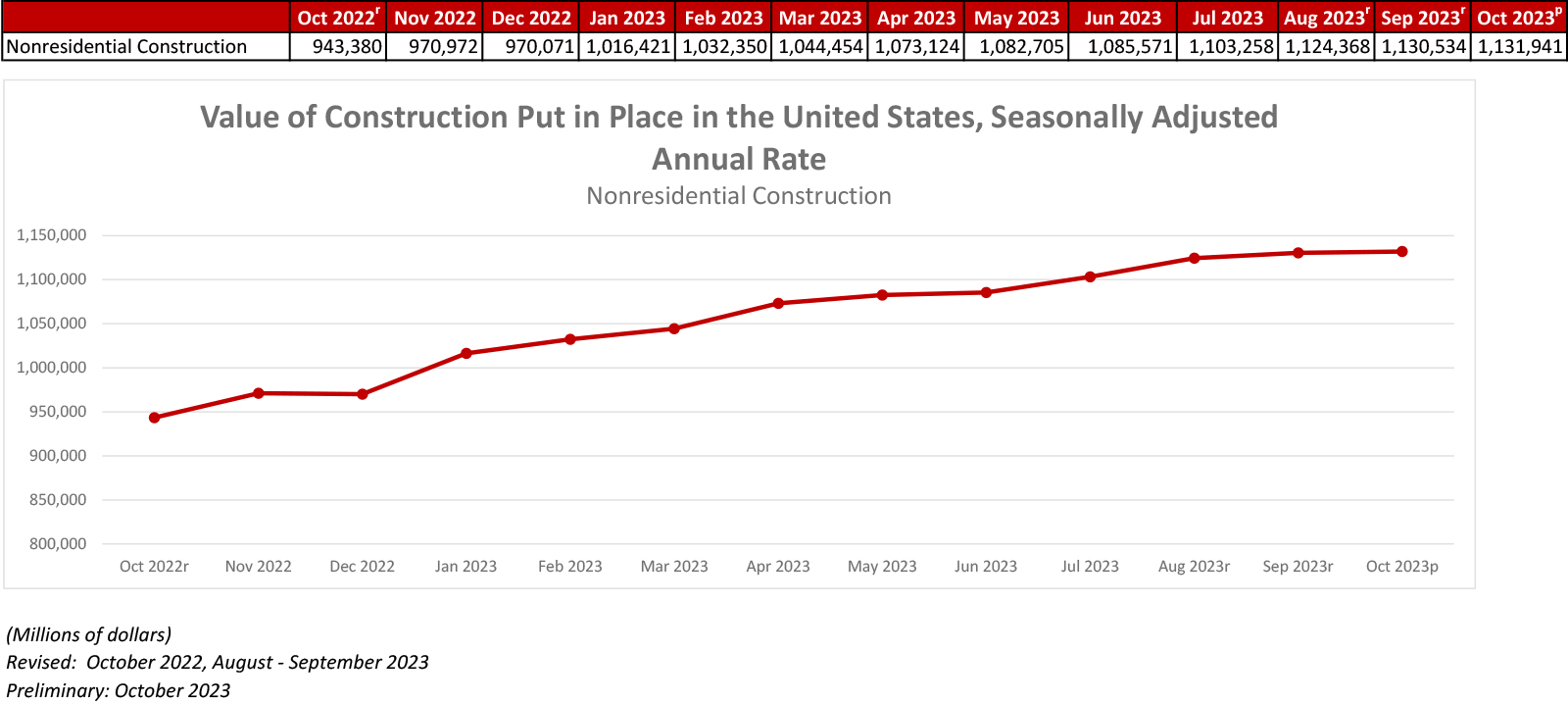

- National nonresidential construction spending increased 0.1% in October.

- On a seasonally adjusted annualized basis, nonresidential spending totaled $1.1 trillion for the month and is up 20% year-over-year.

- "More than 45% of that year-over-year increase is due to surging construction activity in the manufacturing sector, though infrastructure-related categories like highway and street and sewage and waste disposal have also outperformed."

Press Release from Associated Builders and Contractors: ABC: Nonresidential Construction Spending Inches Higher in October, Up 20% Over the Past Year

WASHINGTON, Dec. 1—National nonresidential construction spending increased 0.1% in October, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.1 trillion.

Spending was up on a monthly basis in 8 of the 16 nonresidential subcategories. Private nonresidential spending increased 0.1% in October, while public nonresidential construction spending was up 0.2%.

“Nonresidential construction spending increased for the 17th consecutive month in October and is now up an even 20% over the past year,” said ABC Chief Economist Anirban Basu. “As has been the case, more than 45% of that year-over-year increase is due to surging construction activity in the manufacturing sector, though infrastructure-related categories like highway and street and sewage and waste disposal have also outperformed."

"Spending in the commercial category, which includes construction of distribution and warehouse space, fell sharply in October," said Basu. "This is likely due to a severe slowdown in the freight industry and slowing warehouse-related construction rather than a sudden decline in retail-related construction. Despite weakness in the commercial category and other headwinds like high interest rates and labor shortages, contractors remain optimistic about their sales over the next six months, according to ABC’s Construction Confidence Index."

Press Release from Associated General Contractors of America: Construction Spending Increases 0.6 Percent In October, With Gains For Public And Private Nonresidential Projects, Along With Homebuilding

Mixed Patterns within Categories Suggest Market is Shifting but Remains Strong Overall; Manufacturing, Power, Education, and Single-Family Spending Pickup Offset Drop in Highway and Multifamily Projects

Total construction spending increased by 0.6 percent in October, led by strong gains for manufacturing, power, and education projects as well as single-family homebuilding, according to an analysis of federal spending data the Associated General Contractors of America released today. Association officials noted, however, that spending on other nonresidential segments, including commercial construction and highway and street construction, declined.

"It is apparent that the construction market overall remains healthy," said Ken Simonson, the association’s chief economist. "But a rotation is occurring among nonresidential segments as manufacturing construction expands while commercial construction slumps and highway and street spending stagnates. On the residential side, single-family construction is picking up, while multifamily is descending from record highs."

Construction spending, not adjusted for inflation, totaled $2.027 trillion at a seasonally adjusted annual rate in October. That figure is 0.6 percent above the September rate, which was revised up from the initial estimate. Both residential and nonresidential spending rose overall but with mixed results by segment.

Spending on private residential construction rose by 1.2 percent, as single-family construction climbed for the sixth-straight month, by 1.1 percent. Spending on multifamily projects dipped 0.2 percent.

Spending on private nonresidential construction edged up 0.1 percent in October, while public construction investment rose 0.2 percent. Spending on the largest nonresidential segment, manufacturing plants, climbed 0.9 percent. Highway and street spending declined 0.4 percent. Spending on commercial construction—comprising warehouse, retail, and farm construction—slumped 1.5 percent. Investment in power, oil, and gas projects rose 1.0 percent. Education spending increased 0.4 percent. Spending on transportation facilities slipped 0.3 percent.

Association officials said that the decline in highway and street construction came as the Biden administration continues to fall behind in implementing recently enacted reforms to the federal permitting process. They added that many state and local officials are having ongoing challenges in following the administration’s complex Buy America rules.

"The Biden administration seems to be suffering from a bit of policy schizophrenia; it talks a lot about wanting to build infrastructure while it keeps working to tie those projects up in red tape," said Stephen E. Sandherr, the association’s chief executive officer. "Simplifying the Buy America rules and making required progress on permitting reform will help boost a wide range of construction activities across the country."