Construction Project Management on the Cutting Edge—Part 3: Streamlining, Better Analyzing Construction Data

Original article by Andy Holtmann on Dexter + Chaney

This is the third installment of a five-part series on how innovative technologies and software are helping project managers streamline processes to build faster, smarter projects

All battle plans are perfect—until the battle begins. Construction project managers probably relate to that statement more that anyone. A construction project can be planned out down to the very last nail, but even in the best-planned project, something always goes awry.

While the lifeblood of the construction company is the construction project, the lifeblood of the project is the people working on it. Hire bad people to manage and build the project? The results will be poor. Hire smart, talented folks with expertise and the results will be good. Hire forward-thinking, open-minded folks ready to try new things and take calculated risks? The results are likely to be even better.

While the lifeblood of the construction company is the construction project, the lifeblood of the project is the people working on it. Hire bad people to manage and build the project? The results will be poor. Hire smart, talented folks with expertise and the results will be good. Hire forward-thinking, open-minded folks ready to try new things and take calculated risks? The results are likely to be even better.

I have run into about as many theories of equipment costing as there are companies, but one of the major decisions an equipment-intensive company faces is the decision to attribute costs to the piece of equipment, or to the jobs where the equipment is used. There are three basic ways that I have seen this done in the industry.

I have run into about as many theories of equipment costing as there are companies, but one of the major decisions an equipment-intensive company faces is the decision to attribute costs to the piece of equipment, or to the jobs where the equipment is used. There are three basic ways that I have seen this done in the industry. This is ultimately a blog about construction software, but stay with me as I put on my “Top Gear” hat and take you on a trip through an automotive analogy.

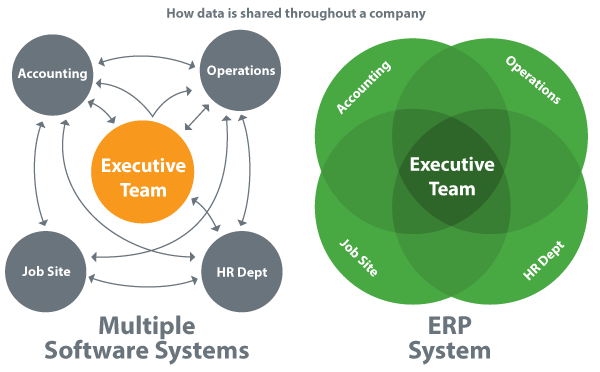

This is ultimately a blog about construction software, but stay with me as I put on my “Top Gear” hat and take you on a trip through an automotive analogy. Just about every contractor today has some form of business and construction management software playing a vital role in keeping projects moving and revenue flowing. Odds are, you’ve worked with or at least entered data into some of these systems. However, when your company outgrows its current software or the software fails to meet specific needs, it may be time to start looking at what new solutions are on the market.

Just about every contractor today has some form of business and construction management software playing a vital role in keeping projects moving and revenue flowing. Odds are, you’ve worked with or at least entered data into some of these systems. However, when your company outgrows its current software or the software fails to meet specific needs, it may be time to start looking at what new solutions are on the market. Expect the unexpected. That’s a mantra every construction manager could do with heeding. But it’s easier said than done. The one thing we don’t want is the unexpected.

Expect the unexpected. That’s a mantra every construction manager could do with heeding. But it’s easier said than done. The one thing we don’t want is the unexpected.