According to data released today by the US Bureau of Labor Statistics:

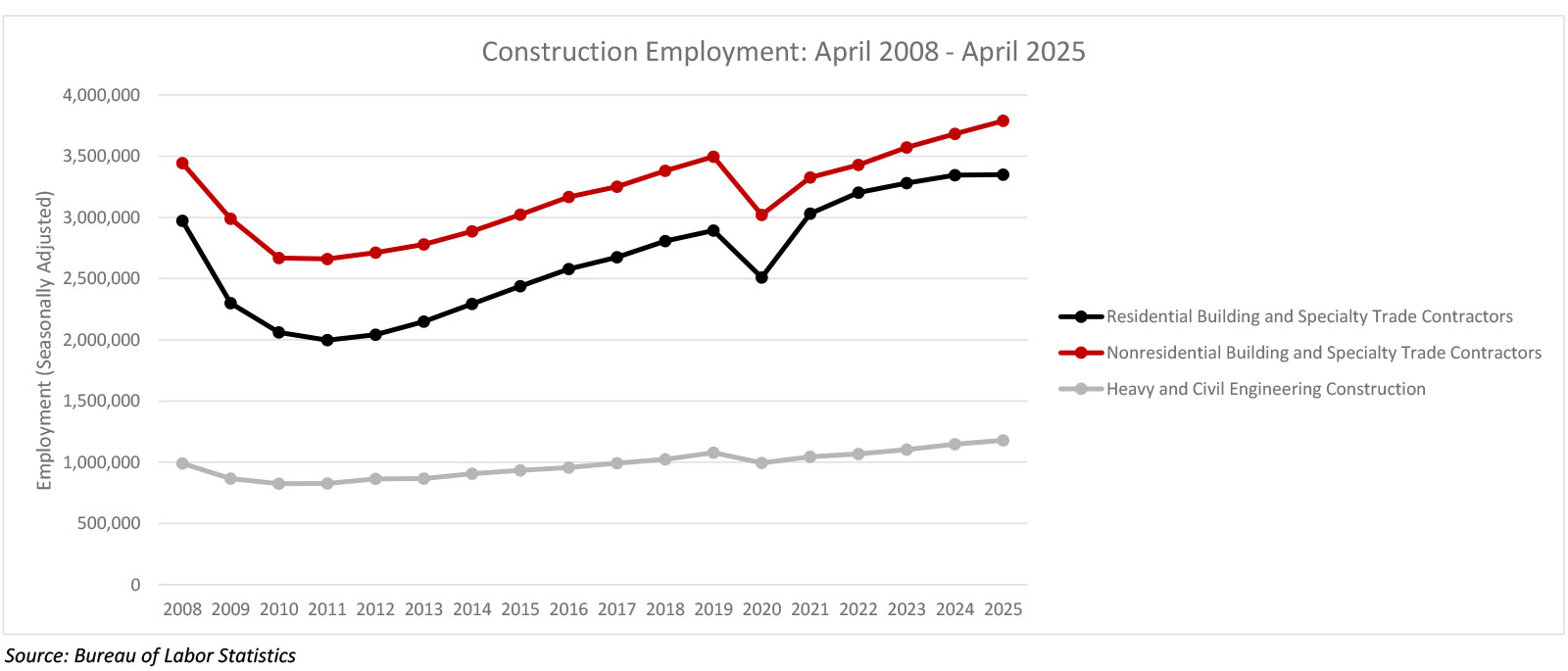

- The construction industry added 11,000 jobs on net in April. Year-over-year, industry employment has risen by 143,000 jobs, or an increase of 1.7%.

- Nonresidential construction employment increased by 8,000 positions on net, with growth in 2 of the 3 subcategories.

- "The reference period for today’s jobs report is the pay period through April 12, which may exclude staffing decisions, or project cancelations or delays, related to recent trade policy developments. While the economic outlook has worsened in recent weeks, it remains unclear how the economy will respond in the coming months. For now, contractors remain broadly optimistic..."

Press Release from Associated Builders and Contractors, Inc (ABC)

ABC: Nonresidential Construction Added Jobs in April Despite Headwinds

WASHINGTON, May 2—The construction industry added 11,000 jobs in April, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Labor Statistics. On a year-over-year basis, industry employment has grown by 143,000 jobs, an increase of 1.7%.

Nonresidential construction employment increased by 8,000 positions on net, with growth in 2 of the 3 subcategories. Nonresidential specialty trade added the most jobs, increasing by 4,900 positions, while nonresidential building added 3,600 jobs. Heavy and civil engineering lost 500 positions for the month.

The construction unemployment rate rose to 5.6%, while unemployment across all industries remained unchanged at 4.2% in April.

“The construction industry added a perfectly acceptable 11,000 jobs in April,” said ABC Chief Economist Anirban Basu. “Despite weak construction spending data for March and several economic headwinds, including high interest rates, tight lending standards and trade policy uncertainty, backlog remains sufficiently elevated to keep industry employment growing for the time being.

“That said, April is likely the last month of economic data largely unaffected by tariffs and tariff-related uncertainty,” said Basu. “The reference period for today’s jobs report is the pay period through April 12, which may exclude staffing decisions, or project cancelations or delays, related to recent trade policy developments. While the economic outlook has worsened in recent weeks, it remains unclear how the economy will respond in the coming months. For now, contractors remain broadly optimistic, according to ABC’s Construction Confidence Index, and industrywide staffing levels continue to expand.”

Press Release from Associated General Contractors of America (AGC)

Industry Adds Jobs at Faster Rate than Overall Economy as Average Hourly Wages Outpace Rise in Private Sector Earnings; Construction Unemployment Rate of 5.6 Percent Matches Year-Ago Level

Construction sector employment increased by 11,000 positions in April as rising wages enabled the industry to add workers more rapidly than other sectors, according to an analysis of new government data the Associated General Contractors of America released today. Association officials said growing uncertainty about the impacts of new tariffs could undermine future employment growth in the sector.

“The construction industry continued to add workers at a faster clip than other sectors in April as the industry boosted pay more than other private employers,” said Ken Simonson, the association’s chief economist. “But uncertainty over tariffs and other policy reversals may cause a halt to many projects and employment gains.”

Construction employment in April totaled 8,316,000, seasonally adjusted, an increase of 11,000 from March. Headcount rose by 218,000 jobs or 2.7 percent during the past 12 months, topping the 1.4 percent growth rate in total nonfarm payroll employment.

In April, nonresidential construction firms added 8,000 workers, with gains of 4,900 among specialty trade contractors and 3,600 in nonresidential building construction firms, which offset a dip of 500 workers at heavy and civil engineering construction firms. Residential construction employment increased by 3,400, as residential specialty trades construction firms added 4,100 positions but homebuilders and other residential building construction firms shed 700 workers.

Average hourly earnings for production and nonsupervisory employees in construction—covering most onsite craft workers as well as many office workers—climbed by 4.5 percent over the year to $36.96 per hour. That gain exceeded the 4 percent rise in pay for such workers in the overall private sector.

The unemployment rate among workers with recent construction experience rose to 5.6 percent in April, up from 5.2 percent a year earlier. The uptick suggest a softening in labor demand. While many firms appear to be holding on to current employees, elevated unemployment and the recent decline in hiring and job openings point to growing uncertainty in parts of the industry, Simonson noted.

Association officials welcomed the monthly job gains, noting that demand for certain types of construction projects, particularly data centers, continues to expand. They noted, however, that many firms remain concerned about labor shortages and the potential impacts of new tariffs. They are working with the Trump administration and Congress to boost funding for construction education and training, and to find a way to allow more people to lawfully enter the country and work in the sector.

“Keeping construction costs stable is key to jumpstarting many projects that have been stalled by market uncertainties,” said Jeffrey D. Shoaf, the association’s chief executive officer. “The best way to do that is to encourage more people to pursue high-paying construction careers and to take steps to mitigate the impacts of tariffs on construction costs.”