Key Takeaways

- National nonresidential construction spending decreased 0.2% in July.

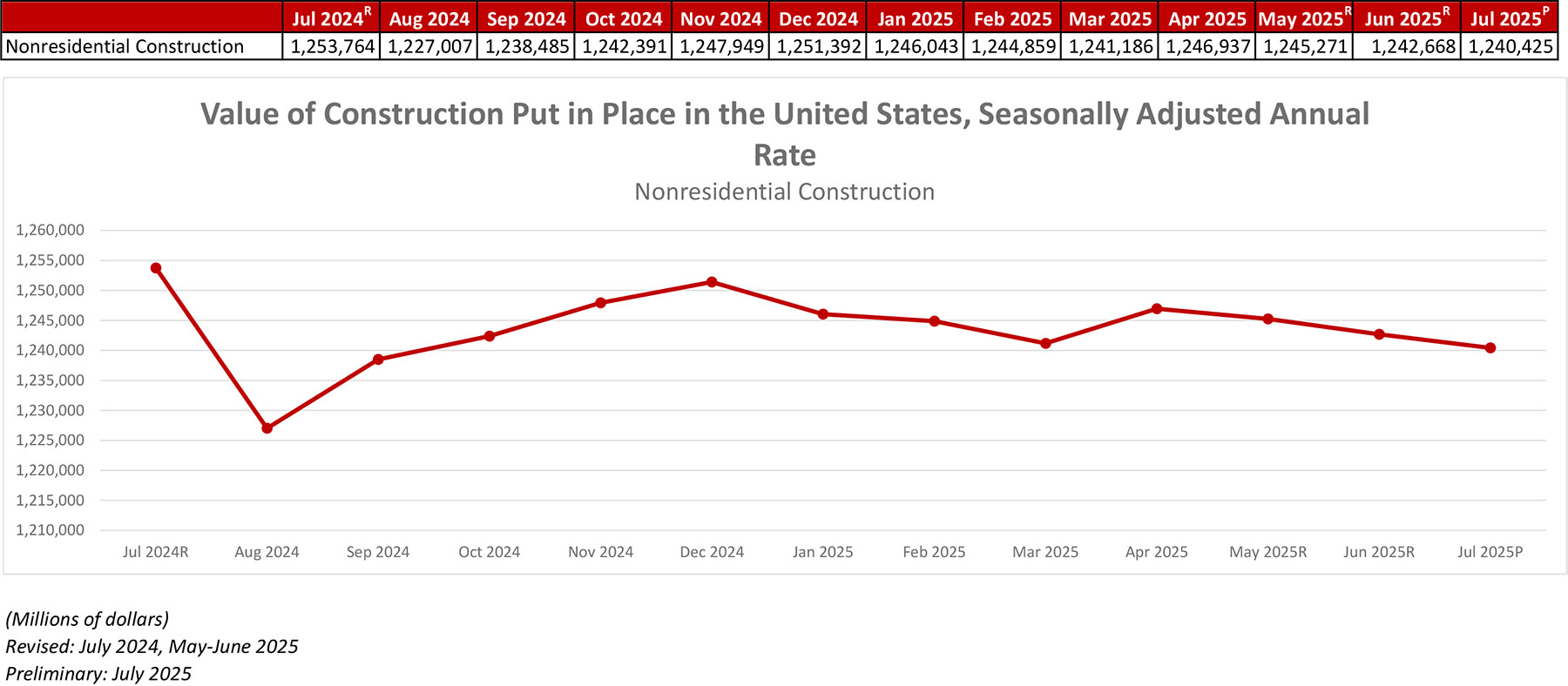

- On a seasonally adjusted annualized basis, nonresidential spending totaled $1.24 trillion for the month.

- "Providing greater certainty on tariff rates and taking steps to address severe construction labor shortages will go a long way in stimulating new demand for construction."

Press Release from Associated Builders and Contractors (ABC)

ABC: Nonresidential Construction Spending Falls Sharply in July

WASHINGTON, Sept. 2—National nonresidential construction spending decreased 0.2% in July, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.24 trillion.

Spending was down on a monthly basis in 7 of the 16 nonresidential subcategories. Private nonresidential spending was down 0.5%, while public nonresidential construction spending was up 0.3% in July.

“Nonresidential construction spending fell for a third consecutive month in July and is now down 2.5% from the December 2023 record high,” said ABC Chief Economist Anirban Basu. “Of course, that’s in nominal terms. With construction materials prices rising rapidly in recent months and set to continue as higher tariff rates go into effect, the recent decline in construction activity is even larger than this data series suggests.”

“Private nonresidential activity has declined at a particularly concerning pace over the past several months and fell another 0.5% in July,” said Basu. “With the exception of the religious category, which represents less than 1% of private nonresidential construction activity, and the power category, which is surging due to data centers and their considerable energy needs, no private subsegment has retained momentum through the first half of 2025.”

“Nearly 1 in 4 ABC members reported having a project interrupted or canceled due to tariffs in July, according to ABC’s Construction Backlog Indicator survey, and that predates the particularly large import tax increases put into effect in early August,” said Basu. “With economic uncertainty still elevated, labor shortages reemerging and materials prices rising, it may be a bleak second half of the year for the construction industry.”

Press Release from Associated General Contractors of America (AGC)

Association Survey Finds Tariffs, Labor Shortages and Other Challenges Have Caused Owners to Cancel, Defer, or Shrink Project Starts as Construction Officials Push for Policy Certainty & Workforce Support

Spending on projects underway in July inched down 0.1 percent from June as declines in private nonresidential and multifamily construction offset pickups in public outlays and single-family homebuilding, according to an analysis of new government data that the Associated General Contractors of America released today. Association officials noted the results are consistent with a survey the association released last week that found many owners have canceled, deferred, or scaled back projects due to tariffs and labor shortages.

“Our survey of construction firms found 16 percent of contractors reported projects had been canceled, postponed, or scaled back as owners’ demand or need changed due to tariffs while 45 percent of firms report project delays because of labor shortages,” said Ken Simonson, the association’s chief economist. “And 26 percent of firms said projects had been affected by changes in owners’ demand or need due to other policy changes such as federal funding, taxes, and regulations.”

Spending totaled $2.14 trillion at a seasonally adjusted annual rate in July. The total was nearly identical to the May rate, following an increase of 0.1 percent in June rate and a similar decline in July.

The construction spending total was dragged down by decreases in private nonresidential and multifamily projects, which slipped 0.5 percent and 0.4 percent, respectively, from June to July. There were declines in the four largest private nonresidential categories. Manufacturing and private power construction each slumped by 0.7 percent. Commercial construction slid 0.9 percent and private office construction dipped by 0.2 percent.

Public construction outlays and single-family homebuilding rose 0.3 percent and 0.1 percent, respectively, from June to July. Nevertheless, the two largest public segments, highway and street construction and educational spending, each edged down by 0.1 percent.

Association officials said the new spending data and survey results underscore the need for greater policy certainty. They urged the Trump administration to quickly resolve trade disputes to end the threat of retaliatory tariffs. They continued to call for short and long-term workforce development measures, including new pathways for people to enter the country and work in construction and more investments in construction training and education programs.

“It is difficult for developers to launch new construction projects when they don’t know how much the project will cost or how long it will take to finish,” said Jeffrey D. Shoaf, the association’s chief executive officer. “Providing greater certainty on tariff rates and taking steps to address severe construction labor shortages will go a long way in stimulating new demand for construction.”