According to data released today by the US Bureau of Labor Statistics:

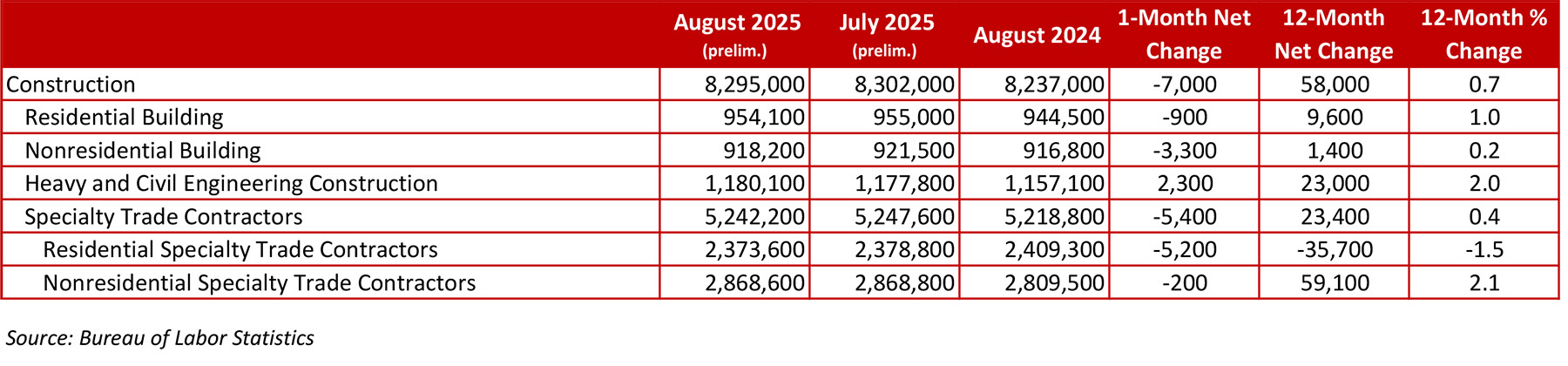

- The construction industry lost 7,000 jobs on net in August. Year-over-year, industry employment has risen by 58,000 jobs, or an increase of 0.7%.

- Nonresidential construction employment decreased by 1,200 positions on net, with losses in 2 of the 3 subcategories.

- "Despite these troubling signs, contractors remain optimistic about their sales over the next six months, according to ABC’s Construction Confidence Index. While that may reflect the notion that weak labor market data will translate into accelerated rate cuts, there is no guarantee that a lower federal funds rate will translate into lower borrowing costs given the current state of the bond market."

Press Release from Associated Builders and Contractors, Inc (ABC)

ABC: Construction Employment Falls for Third Straight Month in August

WASHINGTON, Sept. 5—The construction industry lost 7,000 jobs in August, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Labor Statistics. On a year-over-year basis, industry employment has grown by 58,000 jobs, an increase of 0.7%

Nonresidential construction employment decreased by 1,200 positions on net, with losses in 2 of the 3 subcategories. Nonresidential building lost 3,300 jobs, while nonresidential specialty trade lost 200 positions. Heavy and civil engineering added 2,300 jobs for the month.

The construction unemployment rate dropped to 3.2% in August. Unemployment across all industries increased from 4.2% in July to 4.3% last month.

“The construction industry has now lost jobs in each of the past three months,” said ABC Chief Economist Anirban Basu. “Industrywide employment is up by just 6,000 positions since December, and every subsegment except for heavy and civil engineering lost jobs in August. Despite these job losses, construction labor shortages appear to be worsening as immigration policy weighs on the supply of workers; the construction unemployment rate fell to 3.2% in August, matching the lowest level ever recorded.”

“Construction industry data have been particularly downbeat since March,” said Basu. “With materials prices rising and construction spending shrinking, it’s hardly a surprise that the industry’s workforce is contracting. Despite these troubling signs, contractors remain optimistic about their sales over the next six months, according to ABC’s Construction Confidence Index. While that may reflect the notion that weak labor market data will translate into accelerated rate cuts, there is no guarantee that a lower federal funds rate will translate into lower borrowing costs given the current state of the bond market.”

Press Release from Associated General Contractors of America (AGC)

Association Survey Finds Tariffs, Other Policy Shifts Leading to Project Cancellations and Delays, While Substantial Share of Firms Reports Disruptions from Stepped-Up Immigration Enforcement Activity

Construction sector employment declined by 7,000 positions in August and has remained little changed since December, according to an analysis of new government data the Associated General Contractors of America released today. Association officials noted the results are consistent with a survey the association released last week that found many owners have canceled, deferred, or scaled back projects due to tariffs and labor shortages.

“The latest figures show that nonresidential construction—not only homebuilding—has stalled,” said Ken Simonson, the association’s chief economist. “That fits with reports that owners have hit the pause button on many projects, in large part because of uncertainty over the impact of tariffs and other policy upheavals, as our workforce survey found.”

Despite the lack of employment growth, the unemployment rate for recent construction industry workers in August was only 3.2 percent, tying the record low for August set in 2024, Simonson noted. He said the low industry rate likely is a result of workers leaving the industry to avoid being swept up in immigration enforcement actions, as the association’s survey also indicated.

Construction employment in August totaled 8,295,000, seasonally adjusted, a decline of 7,000 from July and the third consecutive monthly decrease of 13,000 from July. Industry employment has risen by a net of only 6,000 or less than 1 percent since December.

In August, nonresidential construction firms shed a net 1,200 employees, as losses of 3,300 at nonresidential building construction firms and 200 among specialty trade contractors offset a gain of 2,300 workers at heavy and civil engineering firms. Residential construction employment declined by 6,100, including 900 jobs at homebuilders and other residential building construction firms and 5,200 at specialty trade contractors.

The 2025 AGC of America-NCCER Workforce Survey found that 16 percent of construction firms reported owners had canceled, postponed, or scaled back projects resulting from changes in demand or need due to tariffs. Roughly one-fourth, 26 percent, of contractors experienced project setbacks resulting from changes in demand or need due to policy changes in areas such as federal funding, taxes, or regulations. In addition, 28 percent of firms reported immigration enforcement actions in the past six months had affected their projects.

Association officials said these policy upheavals affecting costs, funding, and employment were delaying vitally needed infrastructure, job-creating manufacturing projects, and much-needed housing. They urged officials in Washington to stabilize trade policy and to better target immigration enforcement in a way that does not disrupt construction.

“The economy depends on construction,” said Jeffrey D. Shoaf, the association’s chief executive officer. “Constant changes in tariffs and other federal policies, and misdirected immigration enforcement are interfering with the industry and the broader economy.”