According to data released today by the US Bureau of Labor Statistics:

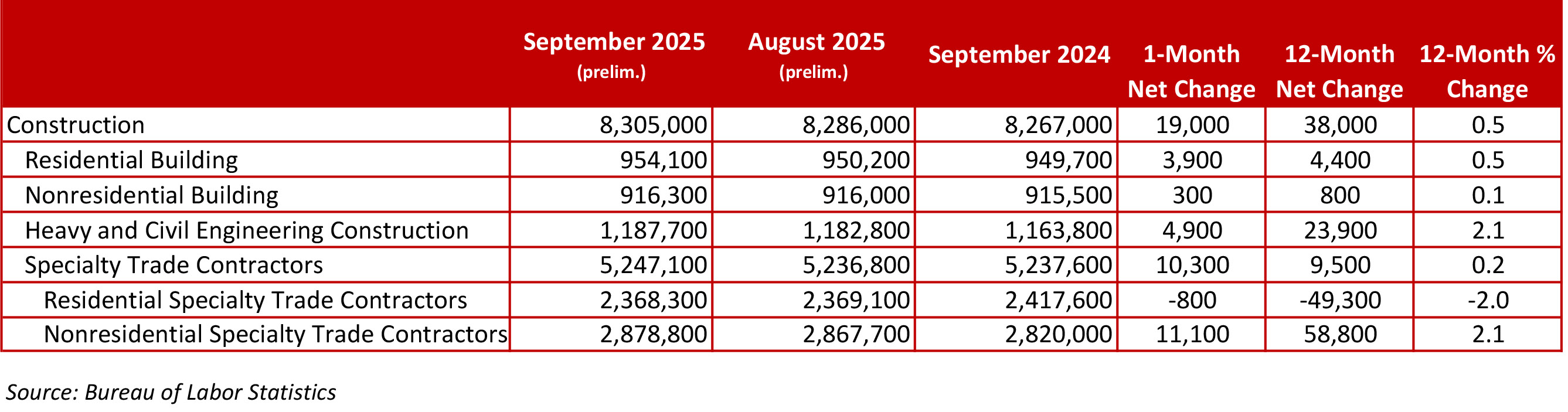

- The construction industry added 19,000 jobs on net in September. Year-over-year, industry employment has risen by 38,000 jobs, or an increase of 0.5%.

- Nonresidential construction employment increased by 16,300 positions on net, with gains in all 3 subcategories.

- "Construction employment increased in September, ending a streak of three consecutive monthly declines. Despite the rebound, the industry has added just 2,000 jobs since March. While weakness is largely concentrated in the residential segment, with nonresidential employment growing at a modest pace over the past year, recent construction spending data suggests that activity in the nonresidential segment is beginning to contract as well."

Press Release from Associated Builders and Contractors, Inc (ABC)

ABC: Construction Employment Rebounds in September

WASHINGTON, Nov. 20—The construction industry added 19,000 jobs on net in September, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Labor Statistics. On a year-over-year basis, industry employment has grown by 38,000 jobs, an increase of 0.5%.

Nonresidential construction employment increased by 16,300 positions, with gains in all three subcategories. Nonresidential specialty trade added 11,100 jobs, while heavy and civil engineering and nonresidential building added 4,900 and 300 jobs, respectively.

The construction unemployment rate increased to 3.8% in September. Unemployment across all industries increased from 4.3% in August to 4.4% last month.

“Construction employment increased in September, ending a streak of three consecutive monthly declines,” said ABC Chief Economist Anirban Basu. “Despite the rebound, the industry has added just 2,000 jobs since March. While weakness is largely concentrated in the residential segment, with nonresidential employment growing at a modest pace over the past year, recent construction spending data suggests that activity in the nonresidential segment is beginning to contract as well.

“Even with the industry’s paltry job growth in 2025, the construction unemployment rate remained relatively low in September at 3.8%,” said Basu. “While that dynamic—tepid hiring but stable unemployment—indicates a lack of labor force growth, construction wages grew at a healthy pace for the month, suggesting that labor shortages are no longer putting significant upward pressure on labor costs.

“Contractors remain confident that hiring will pick back up over the next six months,” said Basu. “Nearly half of ABC members expect their staffing levels to increase over the next six months, while fewer than 12% expect them to contract, according to ABC’s Construction Confidence Index. Because the BLS will not publish October employment data due to the government shutdown, the industry won’t have another assessment of its labor market health until the November data are published on Dec. 16.”

Press Release from Associated General Contractors of America (AGC)

Monthly Increase in Nonresidential Hiring Outpaces Smaller Gains in Residential Construction; Overall Industry Unemployment Rate Edges Up, However, but Stays Below Overall National Rate

Construction employment increased by 19,000 positions in September as firms raised wages to bring on board workers more rapidly than other sectors, according to an analysis of new government data the Associated General Contractors of America released today. Association officials noted that firms continue to add employees to keep pace with demand for public sector projects and data centers, even as other segments of the industry are experiencing slowing demand.

“The employment data are consistent with the August spending numbers that show rising demand for public construction, including a large heavy-civil component,” said Macrina Wilkins, the association’s senior research analyst. “Those public-sector gains are being partly offset, however, by declining private sector demand for many types of construction projects.”

Construction employment in September totaled 8,305,000, seasonally adjusted, an increase of 19,000 from August. Headcount rose by 38,000 jobs or 0.5 percent during the past 12 months, just under the 0.8 percent growth rate in total nonfarm payroll employment. August’s figures were also revised downward, with the initially reported 7,000 job loss nearly doubling to 14,000, indicating the labor market was weaker heading into September than earlier estimates suggested.

Nonresidential construction firms added 16,300 jobs in September, marking continued growth across much of the sector. Employment increased by 11,100 among nonresidential specialty trade contractors, while nonresidential building construction added 300 jobs and heavy and civil engineering gained 4,900. Meanwhile, residential construction employment rose by 3,100 jobs, driven by a gain of 3,900 in residential building, even as residential specialty trade contractors shed 800 positions.

Average hourly earnings for production and nonsupervisory employees in construction—including most onsite craft workers and many office staff—increased 4.0 percent over the year to $37.64. That gain exceeded the 3.8 percent rise in pay for such workers in the overall private sector. The unemployment rate among workers with recent construction experience inched up to 3.8 percent in September, but still sits below the overall nonfarm rate of 4.3 percent (not seasonally adjusted).

Association officials said the fact firms continued to add construction jobs during a period of uncertainty about whether the government would close and outstanding questions about future tariff rates shows contractors are optimistic demand will remain strong. They continued to urge federal officials to resolve trade disputes, set clear tariff levels and take steps to expand the construction workforce.

“Despite some significant economic uncertainties, construction firms remain optimistic enough to continue adding to their payrolls,” said Jeffrey D. Shoaf, the association’s chief executive officer. “The best way to sustain that momentum is by providing clarity about tariff levels, stabilizing materials prices and developing a more robust workforce.”