Key Takeaways

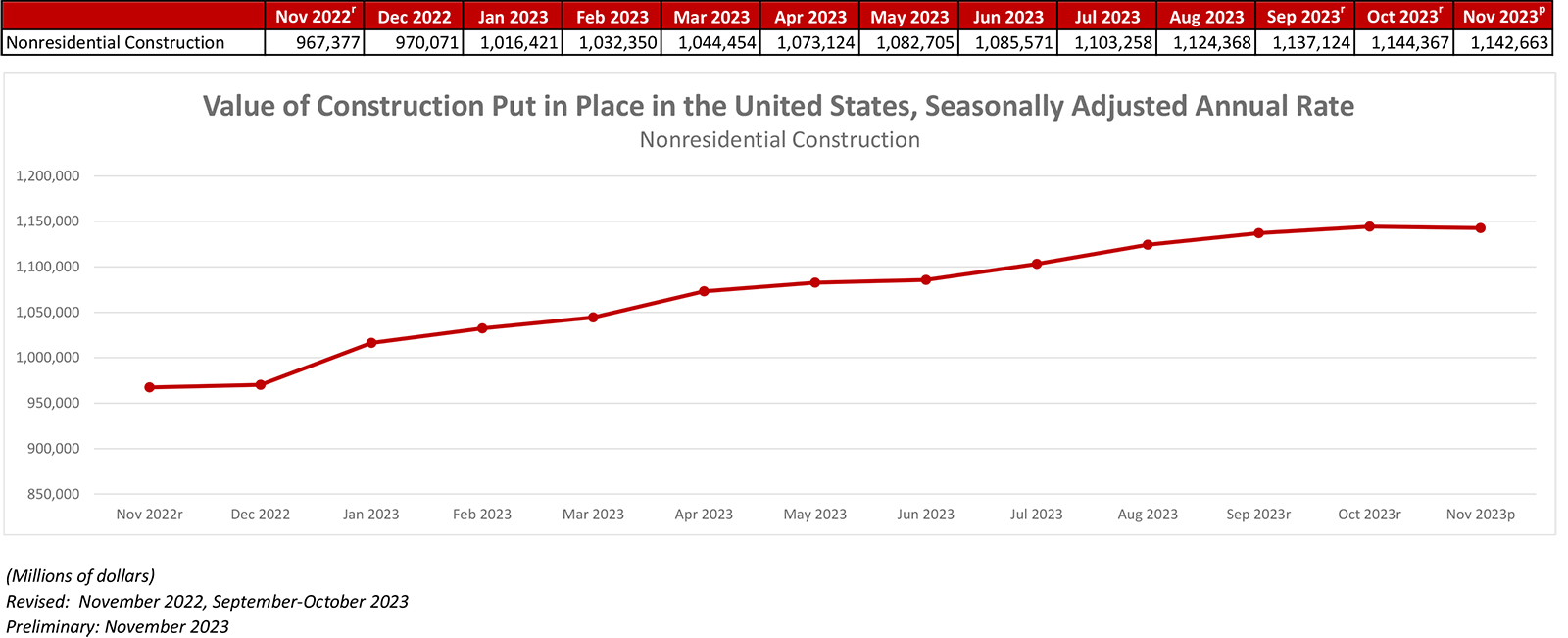

- National nonresidential construction spending dipped 0.1% in November.

- On a seasonally adjusted annualized basis, nonresidential spending totaled $1.143 trillion for the month and is up year-over-year.

- "Despite the monthly setback, spending is up an impressive 18.1% over the past year, with the gains evenly distributed between the public and private sectors, and currently sits just below the all-time high established in October."

Press Release from Associated Builders and Contractors: ABC: Nonresidential Construction Spending Dips 0.1% in November

WASHINGTON, Jan. 3—National nonresidential construction spending decreased 0.1% in November, according to an Associated Builders and Contractors analysis of data published by the U.S. Census Bureau on Jan. 2. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.143 trillion.

Spending was down on a monthly basis in 11 of the 16 nonresidential subcategories. Private nonresidential spending increased 0.2%, while public nonresidential construction spending fell 0.6% in November.

"Nonresidential construction spending dipped in November due to a 0.6% decline in public-sector activity," said ABC Chief Economist Anirban Basu. "Despite the monthly setback, spending is up an impressive 18.1% over the past year, with the gains evenly distributed between the public and private sectors, and currently sits just below the all-time high established in October."

Manufacturing-related construction continues to surge and now accounts for roughly 45% of the year-over-year increase in nonresidential spending," said Basu. "Other predominantly privately financed segments have posted impressive growth in 2023, with educational, health care and power construction all up significantly over the past 12 months, while certain publicly financed categories like highway and street and sewage and waste disposal have also posted strong year-over-year performances. With only 24% of contractors expecting their sales to decline over the next six months, according to ABC’s Construction Confidence Index, the industry appears set to carry momentum into the new year."

Press Release from Associated General Contractors of America: Construction Spending Rises 0.4 Percent In November, As Homebuilding And Private Nonresidential Spending Gains Offset Decline In Public Projects

New Spending Data Comes as Construction Association Gets Ready to Release Industry’s Predictions for Construction Spending Trends in 2024, Need for New Workers & Planned Investments in AI and Other Tech

Total construction spending increased by 0.4 percent in November, as a pickup in homebuilding and some private nonresidential markets offset a downturn in public spending, according to an analysis of federal spending data the Associated General Contractors of America released today. Association officials said the new spending data comes as they and Sage are getting set to release the 2024 Construction Hiring & Business Outlook this Thursday that includes the industry’s predictions for spending trends for the year.

"Private construction spending is showing renewed vigor in homebuilding and selected private nonresidential categories, while developer-financed spending languishes," said Ken Simonson, the association’s chief economist. "Unfortunately, public construction spending appears to have stalled."

Construction spending, not adjusted for inflation, totaled $2.050 trillion at a seasonally adjusted annual rate in November. That figure is 0.4 percent above the upwardly revised October rate. Spending on private residential construction rose by 1.1 percent, as single-family construction climbed for the seventh-straight month, by 2.9 percent. Spending on multifamily projects edged up 0.1 percent.

Spending on private nonresidential construction rose 0.2 percent in November, the fifth consecutive monthly increase. The largest segment, manufacturing construction, climbed 0.5 percent. Among other large private categories, commercial construction—comprising warehouse, retail, and farm projects—declined 0.5 percent, while investment in power, oil, and gas projects rose 0.8 percent. Spending on offices and data centers, as well as private health care facilities, was virtually unchanged.

Public construction spending slumped 2.2 percent in November despite a minimal 0.1 percent increase in the largest category, highway and street construction. Spending on educational structures slipped 0.3 percent. Spending on transportation facilities fell 1.0 percent. Spending on other infrastructure categories tumbled even more: 1.6 percent for sewage and waste disposal, 1.4 percent for water supply, and 4.4 percent for conservation and development.

Association officials said the new construction spending data was helpful for understanding what has been happening in the industry. They added, however, that the Outlook they are releasing at noon eastern on Thursday will show where contractors expect demand for construction to expand and to contract this year. The new Outlook will also predict whether the industry plans to add jobs and what kind of investments it will make in AI and other forms of technology.

"Understanding what has happened to the industry is important, but knowing what will happen is even more important," said Stephen E. Sandherr, the association’s chief executive officer. "The new Outlook we will release with Sage will offer a comprehensive look into what the industry expects to happen in 2024."