Key Takeaways

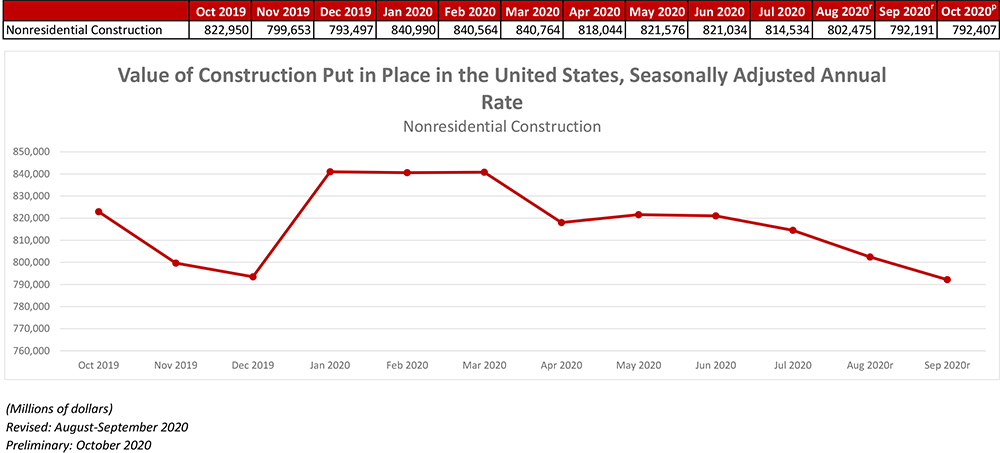

- National nonresidential construction spending was virtually unchanged in October.

- On a seasonally adjusted annualized basis, spending totaled $792.4 billion for the month.

- “The longer-term outlook is decidedly more upbeat. At some point, there will likely be a combination of additional stimuli (including money for infrastructure) and widespread vaccine availability. Recent announcements by Moderna, Pfizer, Astra Zeneca and others have rendered it clear that COVID-19 can be soundly defeated. It is also likely that, at some point in 2021, the economy will take off. As air travel, restaurants and theaters begin to rebound, the recovery to come may be more impressive than the recovery that has occurred over the past six months. That should set the stage for better nonresidential construction spending dynamics in 2022 and 2023.”

Press Release from Associated Builders and Contractors, Inc.

WASHINGTON, Dec. 1— National nonresidential construction spending was virtually unchanged in October, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted, annualized basis, spending totaled $792.4 billion for the month.

Of the sixteen nonresidential subcategories, nine were down on a monthly basis and nine were down on an annual basis. Private nonresidential spending fell 0.7%, while public nonresidential construction spending was up 1.0% in October.

“Excluding some of the emergency construction, such as temporary expansions to healthcare capacity, that transpired in October due to increasing cases of COVID-19, nonresidential construction spending actually declined for the month,” said ABC Chief Economist Anirban Basu. “Spending weakness was broad-based but was especially apparent in private construction segments, such as lodging, office and power. Construction spending in the commercial segment has remained flat on a year-over-year basis, with spending on fulfillment center construction offsetting declining demand for the construction of stores. Commercial and institutional backlog is down 1.7 months since the beginning of the pandemic, according to ABC’s Construction Backlog Indicator, suggesting that declining commercial activity will eventually become apparent within the spending data.

“The near-term outlook is tilted toward the negative as the economic momentum that has been apparent since May begins to wane,” said Basu. “A near-term recession is possible, and perhaps even probable, as shutdown measures are renewed and the impact of previously implemented stimuli continues to fade. That will further delay the recovery of construction spending.

“The longer-term outlook is decidedly more upbeat,” said Basu. “At some point, there will likely be a combination of additional stimuli (including money for infrastructure) and widespread vaccine availability. Recent announcements by Moderna, Pfizer, Astra Zeneca and others have rendered it clear that COVID-19 can be soundly defeated. It is also likely that, at some point in 2021, the economy will take off. As air travel, restaurants and theaters begin to rebound, the recovery to come may be more impressive than the recovery that has occurred over the past six months. That should set the stage for better nonresidential construction spending dynamics in 2022 and 2023.”

Press Release from Associated General Contractors of America (AGC)

Press Release from Associated General Contractors of America (AGC)

Nonresidential Construction Spending Remains Flat In October While Residential Construction Expands As Many Commercial Projects Languish

Demand For Most Types of Nonresidential Projects Remains Flat Amid COVID-Uncertainty, Dwindling State and Local Budgets and the Lack of New Federal Coronavirus Relief Measures, Putting Jobs at Risk

The construction industry’s fortunes continued to diverge in October, as residential construction expanded again while nonresidential construction remained largely unchanged from a month ago and is down compared to last year, according to an analysis of new federal construction spending data by the Associated General Contractors of America. Association officials said that demand for nonresidential construction is being hit by private sector worries about the coronavirus, tighter state and local budgets and the lack of new federal pandemic relief measures.

“The October spending report shows private nonresidential construction is continuing to slide,” said Ken Simonson, the association’s chief economist. “Public construction spending has fluctuated in recent months but both types of nonresidential spending have fallen significantly from recent peaks this year and appear to be heading even lower.”

Construction spending in October totaled $1.44 trillion at a seasonally adjusted annual rate, an increase of 1.3 percent from the pace in September and 3.7 percent higher than in October 2019. But the gains were limited to residential construction, which increased 2.9 percent for the month and 14.6 percent year-over-year. Meanwhile, private and public nonresidential spending was virtually unchanged from September and declined 3.7 percent from a year earlier.

Private nonresidential construction spending declined for the fourth month in a row, slipping 0.7 percent from September to October, with decreases in nine out of 11 categories. The October total was 8.2 percent lower than in October 2019. The largest private nonresidential segment, power construction, declined 0.8 percent for the month. Among the other large private nonresidential project types, commercial construction—comprising retail, warehouse and farm structures—slid 1.0 percent, manufacturing construction declined 0.8 percent, and office construction dipped 0.2 percent.

Public construction spending increased 1.0 percent in October and 3.7 percent year-over-year. The largest public category, highway and street construction, gained 1.6 percent for the month. Among other large public segments, educational construction increased 1.1 percent for the month and transportation construction rose 1.0 percent.

Private residential construction spending increased for the fifth consecutive month, rising 2.9 percent in October. Single-family homebuilding jumped 5.6 percent for the month, while multifamily construction spending rose 1.2 percent and residential improvements spending was flat.

Association officials said demand for nonresidential construction was unlikely to rebound in the near-term without new federal relief measures, putting additional construction careers at risk. These should include new investments in infrastructure, to improve aging roads and bridges, public buildings and water utility networks. Federal officials should refrain from taxing Paycheck Protection Program loans as it would undermine the benefits of that program. And Congress and the administration should work together to enact liability reforms to protect honest firms from frivolous coronavirus lawsuits.

“As long as the coronavirus undermines private sector confidence and public sector budgets, the only way to save good-paying construction careers is through new federal relief measures,” said Stephen E. Sandherr, the association’s chief executive officer. “Fixing the nation’s infrastructure, preserving the benefits of the PPP program and protecting honest employers will give the economy a much-needed short-term boost.”