According to data released last week by the US Bureau of Labor Statistics, the national construction industry gained 0 jobs on net in April.

Key Takeaways

- Construction industry employment was unchanged in April.

- "While many observers are shocked by today’s disappointing employment report, contractors and other employers have been signaling for weeks that all is not right in America’s labor market,” said ABC Chief Economist Anirban Basu. “In particular, a growing chorus of employers indicates difficulty filling available job openings. Demand for human capital is elevated in many industries, but a combination of stimulus payments, stepped up unemployment insurance benefits, lingering fear of infection and remote schooling is slowing growth in labor force participation."

Press Release from Associated Builders and Contractors, Inc (ABC)

Construction Employment Unchanged in April, Says ABC

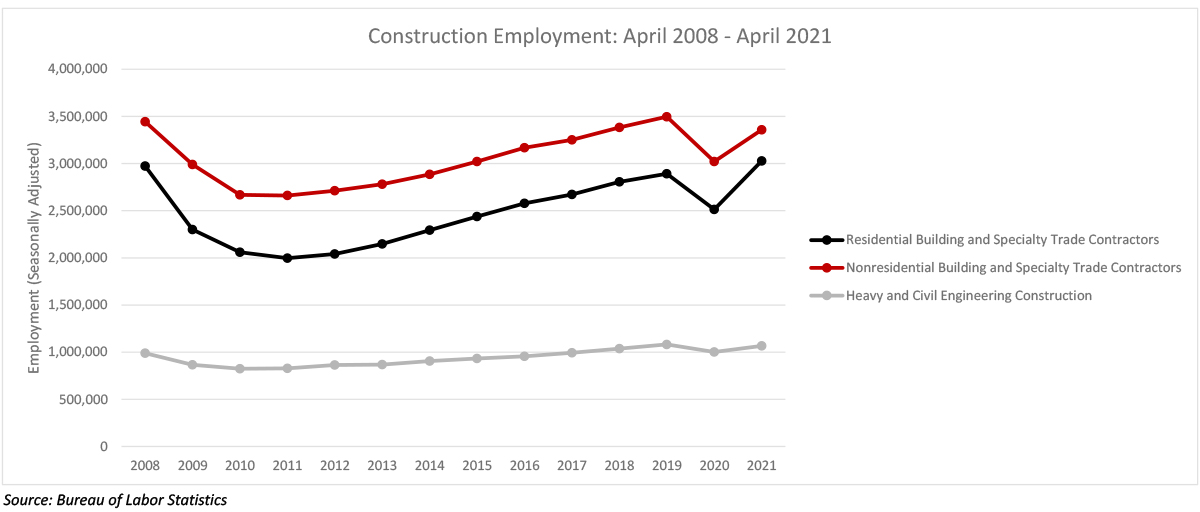

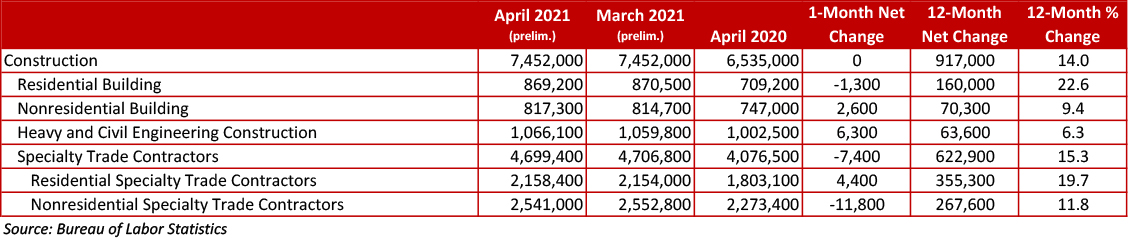

WASHINGTON, May 7—Construction industry employment remained unchanged in April, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Labor Statistics. Over the last year, the industry has added 917,000 jobs, recovering 82.4% of the jobs lost during the first months of the COVID-19 pandemic.

Nonresidential construction lost 2,900 jobs in April, driven entirely by losses among nonresidential specialty trade contractors (-11,800). This decline was offset by gains in heavy and civil engineering (+6,300) and nonresidential building (+2,600).

The construction unemployment rate fell from 8.6% in March to 7.7% in April. Unemployment across all industries inched a tenth of a percentage point higher to 6.1%.

“While many observers are shocked by today’s disappointing employment report, contractors and other employers have been signaling for weeks that all is not right in America’s labor market,” said ABC Chief Economist Anirban Basu. “In particular, a growing chorus of employers indicates difficulty filling available job openings. Demand for human capital is elevated in many industries, but a combination of stimulus payments, stepped up unemployment insurance benefits, lingering fear of infection and remote schooling is slowing growth in labor force participation.

“There are problematic supply side factors as well,” said Basu. “Input shortages ranging from softwood lumber and steel to copper and semiconductors have pushed materials costs higher while simultaneously slowing down the ramping of production. Not coincidentally, despite elevated demand for vehicles, employment in the motor vehicles and parts manufacturing segment declined 27,000 in April.

“Based on ABC’s Construction Confidence Index, the typical contractor expects sales, staffing and margins to expand over the next six months,” said Basu. “As vaccination rates increase and infection rates turn lower, accumulated household savings combined with more effective supply chains should translate into improving economic performance. That in turn will help lift demand for construction services later this year and into 2022.”

Press Release from Associated General Contractors of America (AGC)

Association Officials Note that Production & Shipping Delays are Driving Up Materials Prices and Delaying Projects, While Pandemic and Federal Unemployment Supplements Make It Harder to Hire

Construction employment was unchanged from March to April as nonresidential contractors and homebuilders alike struggled to obtain materials and find enough workers, according to an analysis by the Associated General Contractors of America of government data released today. Association officials said the industry’s recovery was being hampered by problems getting stable prices and reliable deliveries of key materials, while the pandemic and federal policies were making it harder for firms to find workers to hire.

“Contractors are experiencing unprecedented intensity and range of cost increases, supply-chain disruptions, and worker shortages that have kept firms from increasing their workforces,” said Ken Simonson, the association’s chief economist. “These challenges will make it difficult for contractors to rebound as the pandemic appears to wane.”

Construction employment in April totaled 7,452,000, matching the March total but amounting to 196,000 employees or 2.6 percent below the most recent peak in February 2020. The number of former construction workers who were unemployed in April, 768,000, dropped by half from a year ago and the sector’s unemployment rate fell from 16.6 percent in April 2020 to 7.7 percent last month.

“The fact that employment has stalled—despite strong demand for new homes, remodeling of all types, and selected categories of nonresidential projects—suggests that contractors can’t get either the materials or the workers they need,” Simonson added. The economist noted that many firms report key materials are backlogged or rationed, while others report they are having a hard time getting former workers to return to work. He added these factors are contributing to rising costs for many contractors, which are details in the association’s updated Construction Inflation Alert.

Although employment was nearly stagnant for the month for both residential and nonresidential construction, the sectors differ sharply in their recovery since the pre-pandemic peak in February 2020. Residential construction firms—contractors working on new housing, additions, and remodeling—gained only 3,000 employees during the month but have added 46,000 workers or 1.6 percent over 14 months. The nonresidential sector—comprising nonresidential building, specialty trades, and heavy and civil engineering contractors—shed 3,000 jobs in April and employed 242,000 fewer workers or 5.2 percent less than in February 2020.

Association officials said that the temporary new federal unemployment supplements appear to be keeping some people from returning to work, while others are being forced to care for dependents not yet back in school or day care, or loved ones afflicted with the coronavirus. They added that federal tariffs and labor shortages within the shipping and manufacturing sector are a major reason for the rising materials prices and supply chain problems.

“Ironically, the latest coronavirus relief bill may actually be holding back economic growth by keeping people away from work at a time when demand is rebounding,” said Stephen E. Sandherr, the association’s chief executive officer. “Federal officials need to look at ways to encourage people to return to work, end damaging tariffs on materials like steel and lumber, and act to ease shipping delays and backlogs.”