According to data released last week by the US Bureau of Labor Statistics, the national construction industry lost 3,000 jobs on net in January.

Key Takeaways

- The construction industry lost 3,000 jobs on net in January 2021.

- "Nonresidential construction employment fell by 1,900 jobs on net in January. Heavy and civil engineering added 2,000 jobs for the month, but those gains were offset by losses in nonresidential specialty trade and nonresidential building, which lost 3,300 and 600 jobs, respectively."

- “Given the damage to many state and local government balance sheets, public construction spending is set to weaken going forward in conjunction with a number of key private segments. That said, there are some areas of current and prospective strength, including fulfillment centers, data centers, manufacturing facilities and healthcare. But much of the industry’s fortunes during the balance of 2021 and into 2022 will depend on policymakers in Washington and their ability to deliver on their commitment to expanding the capabilities of the nation’s infrastructure. Absent a federal infusion of significant and much-needed investment, nonresidential construction is poised to be one of the weaker economic segments in terms of pace of recovery going forward.”

Press Release from Associated Builders and Contractors, Inc (ABC)

Nonresidential Construction Loses Jobs in January, Says ABC

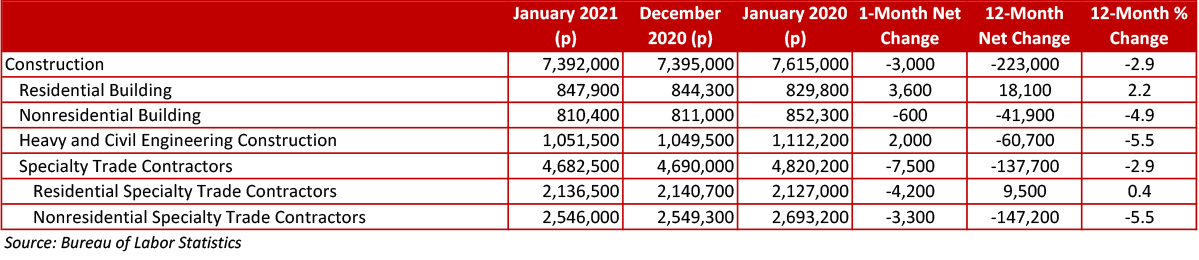

WASHINGTON, Feb. 5—The construction industry lost 3,000 jobs on net in January 2021, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Labor Statistics. During the last nine months, the industry has added 857,000 jobs, recovering 77% of the jobs lost during earlier pandemic stages.

Nonresidential construction employment fell by 1,900 jobs on net in January. Heavy and civil engineering added 2,000 jobs for the month, but those gains were offset by losses in nonresidential specialty trade and nonresidential building, which lost 3,300 and 600 jobs, respectively.

The construction unemployment rate declined to 9.4% in January and is up 4 percentage points from the same time last year. Unemployment across all industries fell from 6.7% in December 2020 to 6.3% last month.

“Multiple forces are shaping nonresidential construction market dynamics, with the result that industry employment has flatlined,” said ABC Chief Economist Anirban Basu. “The construction industry began the COVID-19 crisis with significant backlog, according to ABC’s Construction Backlog Indicator. This industry also has the enviable status of an essential industry in America. That pre-existing strength in a number of public construction segments continues to translate into demand for workers.

“Not coincidentally, heavy and civil engineering, which encompasses road building and similarly situated segments, added jobs in January, said Basu. “At the same time, commercial real estate fundamentals have been hammered during the crisis by online sales and remote work. These factors have reduced demand for construction services in office, lodging and other commercial segments, especially with respect to new construction. Last month, this translated into fewer jobs in both the nonresidential building and specialty trade categories.

“Given the damage to many state and local government balance sheets, public construction spending is set to weaken going forward in conjunction with a number of key private segments,” said Basu. “That said, there are some areas of current and prospective strength, including fulfillment centers, data centers, manufacturing facilities and healthcare. But much of the industry’s fortunes during the balance of 2021 and into 2022 will depend on policymakers in Washington and their ability to deliver on their commitment to expanding the capabilities of the nation’s infrastructure. Absent a federal infusion of significant and much-needed investment, nonresidential construction is poised to be one of the weaker economic segments in terms of pace of recovery going forward.”

Press Release from Associated General Contractors of America (AGC)

Newly Introduced PRO Act and Congressional Efforts to Discriminate Against Certain Construction Training Programs Likely to Disrupt Ongoing Projects and Undermine Efforts to Prepare New Workers

Construction employment stagnated in January, ending eight months of recovery from the pandemic-related losses of early 2020, according to an analysis by the Associated General Contractors of America of government data released today. Association officials added that new measures being considered in Congress, including the PRO Act and the National Apprenticeship Act, threaten to undermine the sector’s recovery by disrupting ongoing projects and hampering employers’ ability to train workers.

“The stagnation in construction employment in January may foreshadow further deterioration in the industry as projects that had started before the pandemic finish up and owners hold off on awarding new work,” said Ken Simonson, the association’s chief economist. “With so much of the economy still shut down or operating at reduced levels, it will likely be a long time before many nonresidential contractors are ready to hire again.”

Construction employment dipped by 3,000 to 7,392,000 in January from a downwardly revised December total. Employment in the sector remains 256,000 or 3.3 percent lower than in February 2020, the most recent peak.

Nonresidential construction has had a much weaker recovery than homebuilding and home improvement construction, Simonson added. While both parts of the industry had huge job losses in early 2020 from the pre-pandemic peak in February to April, residential building and specialty trade contractors have now recouped all of the employment losses they incurred. In contrast, nonresidential construction employment—comprising nonresidential building, specialty trades, and heavy and civil engineering construction—was 259,000 or 5.5 percent lower in January than in February 2020. Only 60 percent of the job losses in nonresidential construction had been erased as of last month.

Unemployment in construction soared over the past 12 months. The industry’s unemployment rate in January was 9.4 percent, compared to 5.4 percent in January 2020. A total of 938,000 former construction workers were unemployed, up from 515,000 a year earlier. Both figures were the highest for January since 2015.

Association officials warned that the newly-introduced PRO Act would hurt construction workers and demand for future projects by unleashing a new wave of labor unrest that could put a halt to many types of construction projects, even those that are not directly involved in a labor dispute with a union. Meanwhile, the National Apprenticeship Act seeks to deny federal funding to registered apprenticeship programs that are not operated with unions. This would undermine the ability of many firms across the country to train and prepare workers.

“Instead of finding ways to build back better, these new congressional proposals would leave many workers unpaid and untrained while projects languish, unfinished,” said Stephen E. Sandherr, the association’s chief executive officer. “It is hard to see how cutting funding to training programs, undermining workers, and crippling the economy will help put more people back to work in construction or other fields.”