According to data released Friday by the US Bureau of Labor Statistics, the national construction industry added 9,000 jobs on net in April.

Key Takeaways

- The construction industry added 9,000 jobs on net in April. Year-over-year, industry employment has risen by 258,000 jobs, or an increase of 3.2%.

- Nonresidential construction employment increased by 7,800 positions on net, with growth in all 3 subcategories.

- "While there is observable weakness in certain industry segments, particularly in the challenging office market, ongoing spending growth in other construction segments has thus far more than fully countervailed that softness. Many megaprojects are just now beginning construction, strongly suggesting a stable U.S. nonresidential construction labor market for months to come."

Press Release from Associated Builders and Contractors, Inc (ABC)

Press Release from Associated Builders and Contractors: ABC: Nonresidential Construction Employment Strength Persists, Jobs Up 7,800 in April

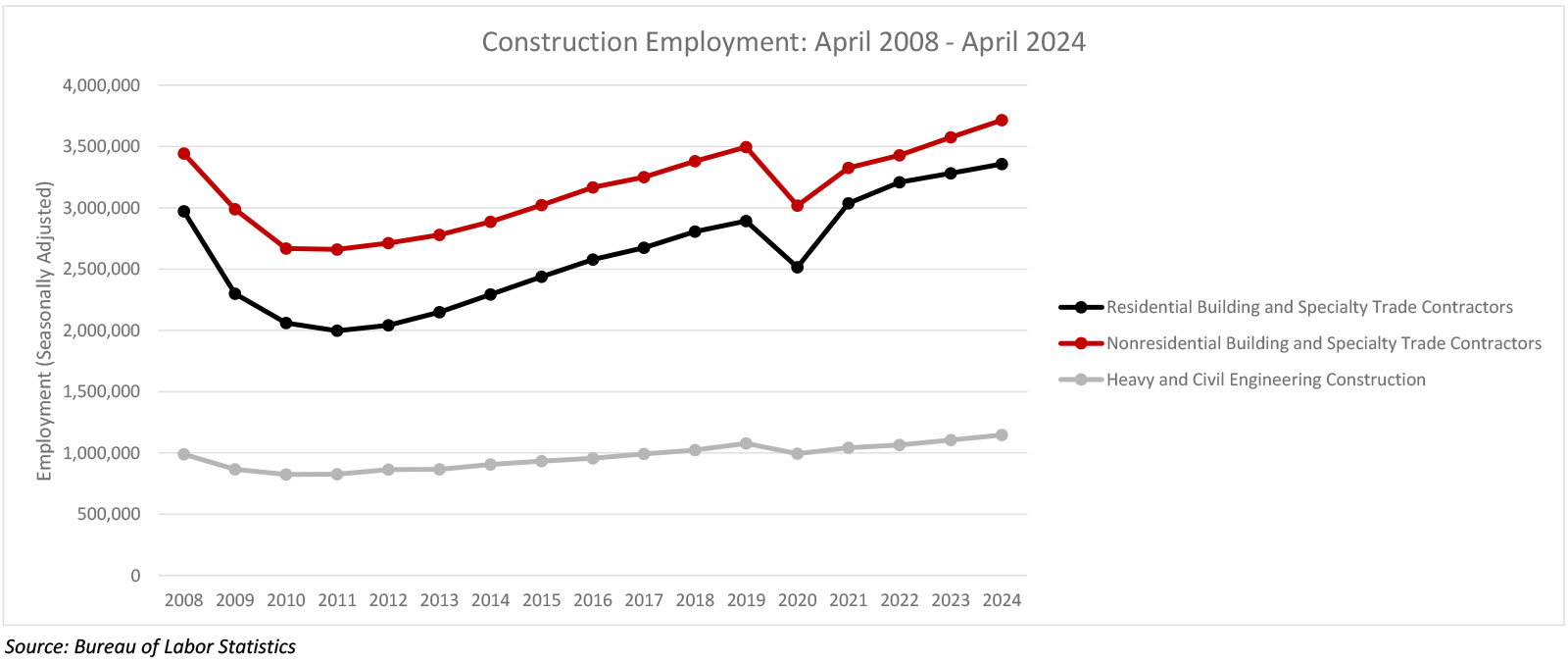

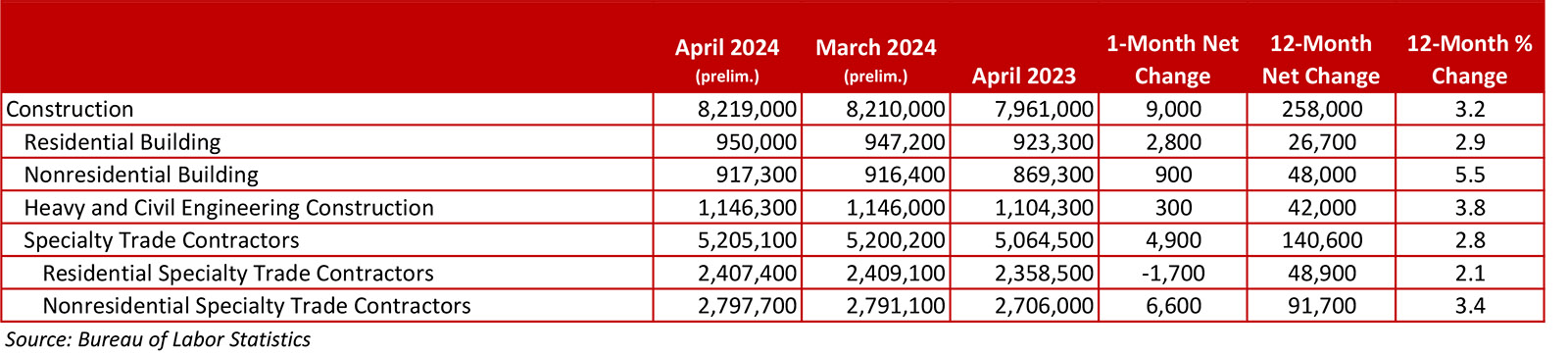

WASHINGTON, May 3—The construction industry added 9,000 jobs on net in April, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Labor Statistics. On a year-over-year basis, industry employment has increased by 258,000 jobs, an increase of 3.2%.

Nonresidential construction employment increased by 7,800 positions on net, with growth registered in all three major subcategories. Nonresidential specialty trade added the most jobs, growing by 6,600 positions. Nonresidential building and heavy and civil engineering added 900 and 300 jobs, respectively.

The construction unemployment rate fell to 5.2% in April. Unemployment across all industries rose from 3.8% in March to 3.9% last month.

“It is really quite remarkable that the nation’s nonresidential construction sector continues to add jobs so consistently in an environment characterized by elevated project financing costs,” said ABC Chief Economist Anirban Basu. “At the heart of growing demand for construction workers in America is the prevalence of megaprojects in many parts of the country, including major manufacturing plants, data centers and public works.

“Based on ABC’s Construction Confidence Index, there is more hiring to come,” said Basu. “While there is observable weakness in certain industry segments, particularly in the challenging office market, ongoing spending growth in other construction segments has thus far more than fully countervailed that softness. Many megaprojects are just now beginning construction, strongly suggesting a stable U.S. nonresidential construction labor market for months to come. Such considerations are also consistent with relatively rapid increases in construction worker compensation during the balance of 2024.”

Press Release from Associated General Contractors of America (AGC)

Nonresidential Building, Specialty Trades, and Heavy & Civil Engineering Construction Contractors Increase Headcount, While Monthly Employment Declines at Residential Specialty Trade Contractors

The construction industry added 9,000 jobs in April—the fewest since August 2022—as a downturn among residential remodelers and subcontractors undercut job gains at nonresidential construction firms, according to an analysis of new government data the Associated General Contractors of America released today. Association officials noted that demand for workers remains high among nonresidential firms, and they urged government officials to enhance support for career development and more employment-based immigration.

“It appears that high interest rates are dragging down remodeling, homebuilding, and apartment construction,” said Ken Simonson, the association’s chief economist. “But firms working on infrastructure, data centers, renewable energy, and manufacturing projects are continuing to add workers and would like to hire more.”

Construction employment in April totaled 8,219,000, seasonally adjusted, a gain of 9,000 from March. Residential specialty trade contractors—firms that work on home remodeling and renovation as well as new construction—shed 1,100 employees. That decline undercut an increase of 2,800 among residential building firms. The three types of nonresidential contractors added a total of 7,800 employees: 900 at nonresidential builders, 6,600 at nonresidential specialty trade contractors, and 300 at heavy and civil engineering construction firms.

Average hourly earnings for production and nonsupervisory employees in construction—covering most onsite craft workers as well as many office workers—climbed by 4.6 percent over the year to $35.47 per hour. Construction firms in April provided a wage “premium” of 18.9 percent compared to the $29.83 average hourly earnings for all private-sector production employees.

Two government reports this week suggest nonresidential demand remains strong, Simonson said. The Census Bureau reported that nonresidential construction spending increased 0.2 percent in March, in contrast to a monthly decline of 0.7 percent for residential spending. In addition, there was a steep decline in layoffs by construction firms in March, implying that contractors expect to need workers in the near future.

Association officials said nonresidential contractors are still struggling to fill positions. They urged government officials at all levels to beef up education and training programs for fields like construction. They also exhorted Congress and the Biden administration to allow construction firms to sponsor qualified foreign workers to ease critical shortages of skilled crafts.

“Current immigration policy and inadequate funding levels for career and technical education programs mean the federal government is failing to provide enough support for construction firms to meet the demand for building infrastructure, renewable energy facilities, and advanced manufacturing plants,” said Jeffrey Shoaf, the association’s chief executive officer. “We need an all-out commitment by government to enable the construction industry to have the skilled workforce to deliver vitally needed projects.”