According to data released last week by the US Bureau of Labor Statistics, the national construction industry added 11,000 jobs on net in July.

Key Takeaways

- Overall, the industry has recovered 886,000 (79.6%) of the jobs lost during earlier stages of the pandemic.

- Nonresidential construction employment expanded by 2,900 positions on net, though more than 100% of the gains were among nonresidential specialty trade contractors, which added 7,500 jobs. The nonresidential building (-2,500) and heavy and civil engineering (-2,100) segments both lost jobs in July.

- "Indeed, there is evidence that the lack of growth in nonresidential construction spending observed in recent months is due to supply constraints as opposed to a lack of demand for construction services. Some contractors are noticing that there are fewer bidders on emerging projects, suggesting that many contractors can no longer pursue additional work.”

Press Release from Associated Builders and Contractors, Inc (ABC)

Nonresidential Construction Adds Only 2,900 Jobs in July, Says ABC

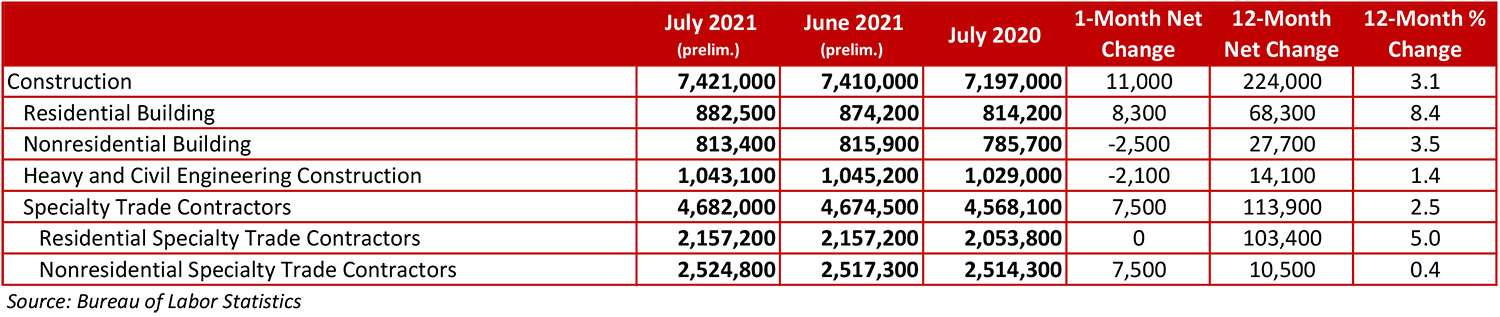

WASHINGTON, August 6—The nation’s construction industry added 11,000 jobs on net in July, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Labor Statistics. Overall, the industry has recovered 886,000 (79.6%) of the jobs lost during earlier stages of the pandemic.

Nonresidential construction employment expanded by 2,900 positions on net, though more than 100% of the gains were among nonresidential specialty trade contractors, which added 7,500 jobs. The nonresidential building (-2,500) and heavy and civil engineering (-2,100) segments both lost jobs in July.

The construction unemployment rate fell to 6.1% in July. Unemployment across all industries declined from 5.9% in June to 5.4% last month.

“While it is easy to identify numerous challenges in the current economic environment, including inflation, input shortages and the delta variant, there is one driving factor that countervails them all and then some,” said ABC Chief Economist Anirban Basu. “That factor is liquidity. With so much money working its way through financial systems, including liquidity injected on a monthly basis by the Federal Reserve, America is in rapid recovery mode with interest rates remaining at absurdly low levels.

“Some of the capital that investors seek to deploy is invested in real estate, which translates into additional construction work,” said Basu. “While construction of new structures remains suppressed in a number of segments like lodging and office due to the dislocating effects of the COVID-induced downturn, there is considerable work underway in terms of modernizing existing structures. That helps explain why nonresidential specialty trade contractors added thousands of jobs last month while general contractors did not.

“Evidence of ongoing rapid recovery is consistent with the upbeat assessments contractors have put forth in ABC’s Construction Confidence Index regarding revenue, staffing and profit margin prospects over the balance of 2021,” said Basu. “Indeed, there is evidence that the lack of growth in nonresidential construction spending observed in recent months is due to supply constraints as opposed to a lack of demand for construction services. Some contractors are noticing that there are fewer bidders on emerging projects, suggesting that many contractors can no longer pursue additional work.”

Press Release from Associated General Contractors of America (AGC)

Association Officials Urged Congress to Pass the New, Bipartisan Infrastructure Bill to Boost Demand for Nonresidential Construction and Create Needed Commercial Construction Career Opportunities

The construction industry added 11,000 jobs between June and July but nonresidential construction employment remains far below pre-pandemic levels, according to an analysis by the Associated General Contractors of America of government data released today. Association officials said nonresidential construction has been affected by declining demand for projects, particularly for public infrastructure work, and urged Congress to quickly pass the new bipartisan infrastructure measure.

“Contractors are plagued by soaring materials costs, long or uncertain delivery times, and hesitancy by project owners to commit to construction,” said Ken Simonson, the association’s chief economist. “Recovery has been especially slow in infrastructure construction.”

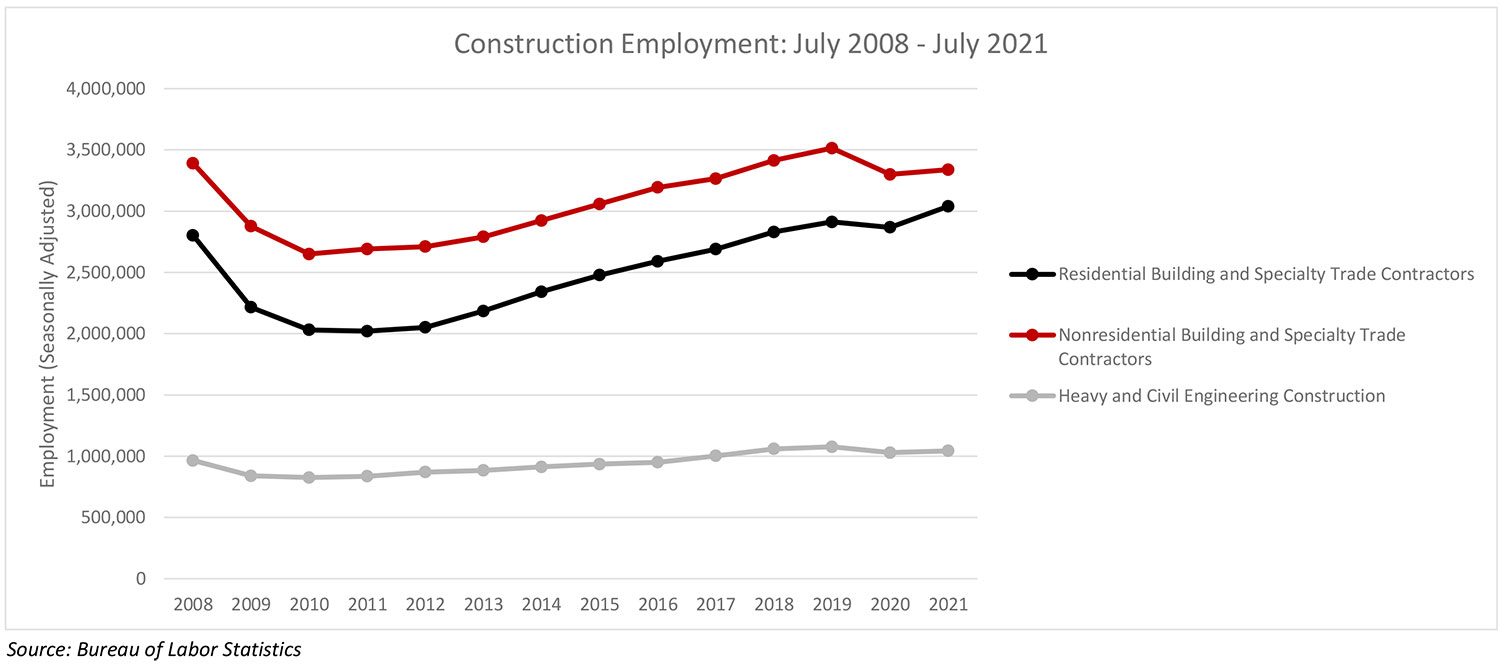

Construction employment in July totaled 7,421,000, a gain of 11,000 from June, following three months of job losses. However, the rebound was limited to residential and specialty trade contractors, while nonresidential building and infrastructure construction firms continued to shed workers.

Residential building contractors such as homebuilders added 8,300 employees in July, while employment was unchanged among residential specialty trade contractors. The two residential segments have added a total of 58,500 employees, or 2.0 percent, to their workforce since February 2020.

In contrast, nonresidential building contractors shed 2,500 employees in July. Employment declined by 2,100 among heavy and civil engineering construction firms—the segment most involved with infrastructure. Nonresidential specialty trade contractors added 7,500 employees in the month. Following the huge loss of jobs between February and April 2020 at the beginning of the pandemic, infrastructure contractors have added back only 37 percent of lost jobs. Nonresidential building and specialty trade contractors have each regained about 60 percent of lost workers, while the total nonfarm payroll economy has recouped 75 percent of workers.

Simonson observed that an unprecedented number of materials are experiencing extreme price increases and long lead times for production or delivery to project sites. These problems mean fewer construction workers are being employed and some owners are delaying project starts, adding to the drag on industry employment. The economist noted that the association has just updated its Construction Inflation Alert, a guide to inform owners, officials, and others about the cost and supply-chain challenges.

Association officials noted the new infrastructure measure boosts federal investments in a wide range of infrastructure projects, which will help generate new demand in the nonresidential sector. They added the bill appears likely to pass in the Senate but that some members of the House want to delay action on the bipartisan measure until passing an unrelated, partisan, spending bill.

“The last thing Washington should be doing is holding up a much-needed, bipartisan infrastructure bill while commercial contractors struggle to add jobs,” said Stephen E. Sandherr, the association’s chief executive officer.