Key Takeaways

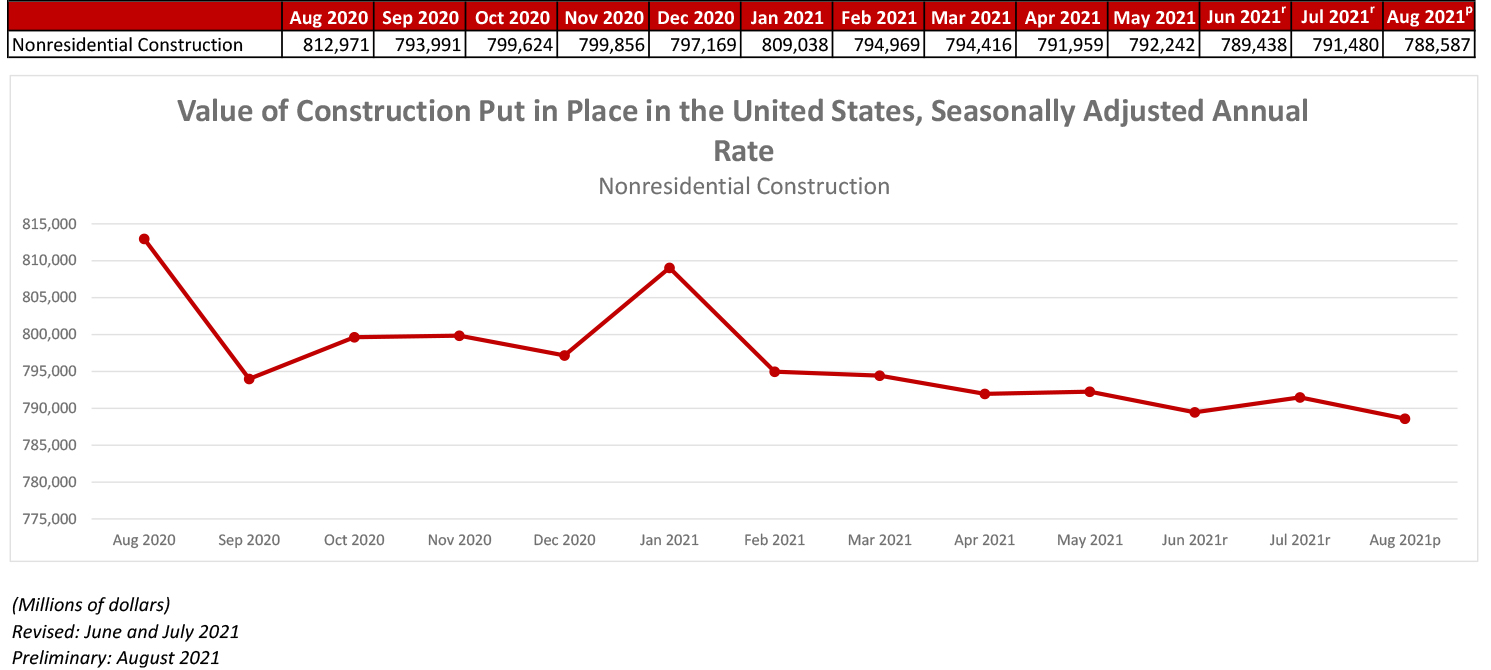

- National nonresidential construction spending declined 0.4% in August 2021.

- On a seasonally adjusted annualized basis, nonresidential spending totaled $788.6 billion for the month.

- “The nonresidential construction spending data are among the most interesting to monitor as the economy continues to wrestle with COVID-19, supply chain disruptions and rampant uncertainty regarding the direction of federal policymaking."

Press Release from Associated Builders and Contractors, Inc.

WASHINGTON, Oct. 1—National nonresidential construction spending fell 0.4% in August, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. Nonresidential spending totaled $788.6 billion in August on a seasonally adjusted annualized basis, down 3.0% from August 2020.

Spending declined on a monthly basis in 10 of the 16 nonresidential subcategories, with spending in transportation unchanged for the month. Private nonresidential spending was down 1.0%, while public nonresidential construction spending rose 0.5% in August.

“The nonresidential construction spending data are among the most interesting to monitor as the economy continues to wrestle with COVID-19, supply chain disruptions and rampant uncertainty regarding the direction of federal policymaking,” said ABC Chief Economist Anirban Basu. “First, nonresidential construction spending dynamics are shaped by all of the major forces shaping economic outcomes today, including labor shortages, surging input prices, massive liquidity and wavering confidence.

“Second, despite the many challenges they have faced, contractors continued to express confidence regarding near-term prospects until recently, per ABC’s Construction Confidence Index,” said Basu. “For economists, who have been focused on phenomena such as the growing volatility of asset prices, rising freight costs, ongoing lockdowns in parts of the global economy and still-high infection rates in America, that expression of abundant confidence has been somewhat surprising. Today’s data release reminds us that challenges abound, with the trajectory of the nonresidential segment remaining on a downward trend that has now been in place for many months.

“Third, a growing number of contractors indicate that the combination of increasingly expensive labor and rising materials prices are inducing more project owners to postpone work,” said Basu. “This has manifested itself in a number of ways, including the inability of nonresidential construction spending to achieve growth and a recent decline in backlog, as measured by ABC’s Construction Backlog Indicator. As if this were not enough, a bipartisan infrastructure package that appeared set to pass is now jeopardized by jumbled political dynamics.”

Construction Spending Stalls Between July And August As Decrease In Nonresidential Projects Negates Ongoing Growth In Residential Work

Most Infrastructure Categories Post Year-to-Date Declines Compared to First Eight Months of 2020; Association Officials Call for Congress, President to Finish Work on Bipartisan Infrastructure Bill

Press release from Associated General Contractors of America

Total construction spending was flat between July and August, as a decrease in nonresidential projects offset continuing gains in residential construction, according to a new analysis of federal construction spending data the Associated General Contractors of America released today. Officials urged the House of Representatives to promptly approve the bipartisan infrastructure bill that passed in the Senate earlier this year, noting that spending on infrastructure in the first eight months of 2021 declined from year-earlier levels.

“Nearly every nonresidential spending segment has deteriorated from already inadequate 2020 levels in the first two-thirds of this year,” said Ken Simonson, the association’s chief economist. “Meanwhile, soaring materials costs mean that fixed public budgets buy even less infrastructure than before.”

Construction spending in August totaled $1.58 trillion at a seasonally adjusted annual rate, virtually unchanged from July. Year-to-date spending increased 7.0 percent from the total for January-August 2020. Gains were limited to residential construction, while nonresidential construction spending slipped in August and year-to-date. The residential construction segment climbed 0.4 percent for the month and 26 percent year-to-date. Combined private and public nonresidential construction spending dropped 0.4 percent compared to July and 6.7 percent over the first eight months of 2021 compared to same interval in 2020.

Most infrastructure categories posted significant year-to-date declines, Simonson pointed out. The largest public infrastructure segment, highway and street construction, was 3.4 percent lower than in January-August 2020. Spending on public transportation construction slumped 6.5 percent year-to-date. Investment in sewage and waste disposal structures climbed 3.8 percent, while funding for public water supply projects slid 1.8 percent and conservation and development construction plunged 18 percent.

Other types of nonresidential spending also decreased year-to-date, Simonson added. Combined private and public spending on electric power and oil and gas projects declined 3.6 percent. Education construction slumped 10.6 percent. Commercial construction--comprising warehouse, retail, and farm structures--dipped 1.7 percent. Office spending fell 10.1 percent and manufacturing construction edged down 0.8 percent.

Association officials said the nearly universal decline in infrastructure spending demonstrates the urgency of enacting expanded funding for a range of infrastructure project types. They called on the House of Representatives to quickly pass the Bipartisan Infrastructure bill that already passed in the Senate by a wide margin.

“This legislation includes the kind of policy priorities that members of both parties have long claimed to support,” said Stephen E. Sandherr, the association’s chief executive officer. “There is no excuse for holding these projects hostage while sorting out other priorities. Construction workers, businesses, and the public are all losing from delay in passing this legislation.”