Key Takeaways

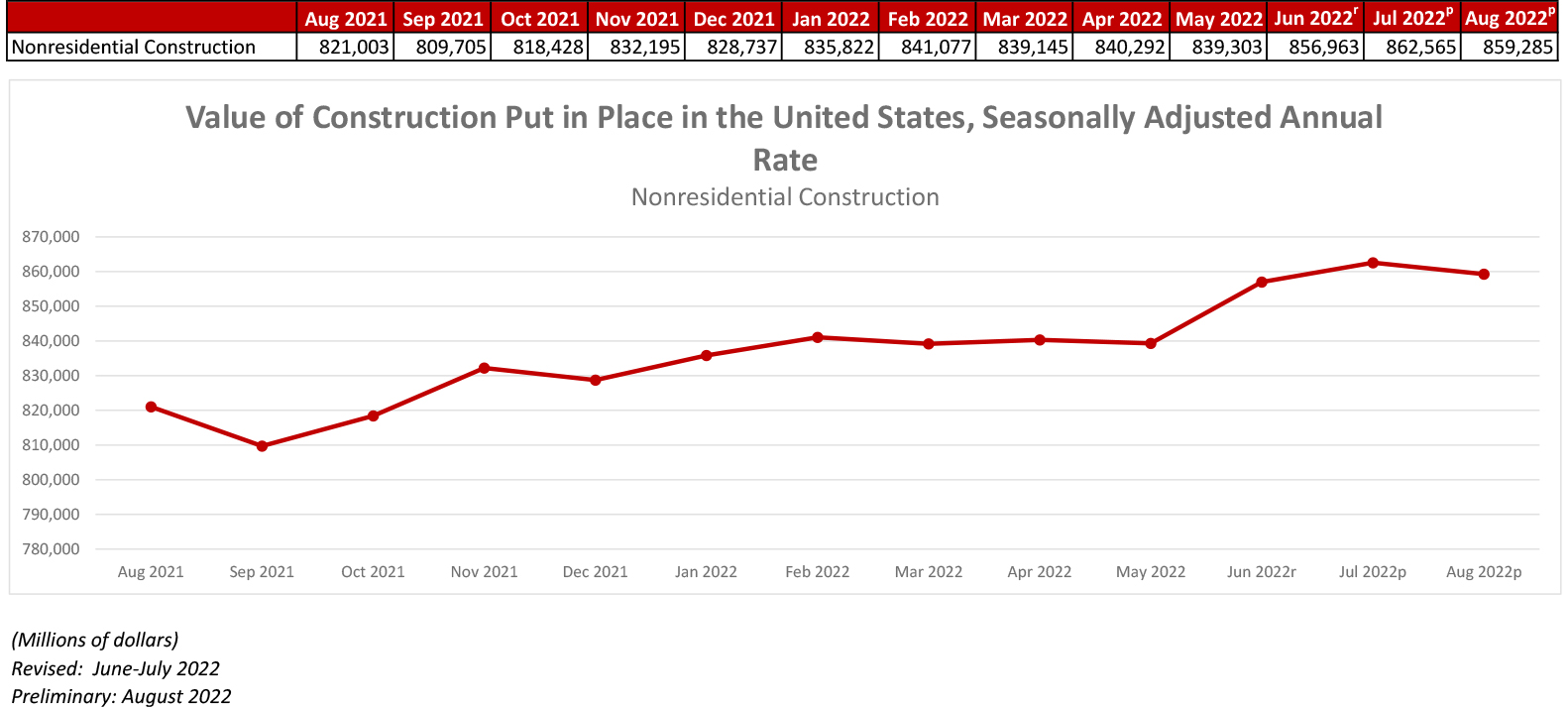

- National nonresidential construction spending decreased 0.4% in August.

- On a seasonally adjusted annualized basis, nonresidential spending totaled $859.3 billion for the month.

- “Federal officials can shore up slowing demand for construction by moving more quickly to fund new projects. Meanwhile, boosting investments in construction training and education programs will help ensure there are enough workers to rebuild after natural disasters and modernize our infrastructure and energy and manufacturing sectors.”

Nonresidential Construction Spending Down 0.4% in August, Says ABC

WASHINGTON, Oct. 3—National nonresidential construction spending was down 0.4% in August, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $859.3 billion for the month.

Spending was down on a monthly basis in 10 of 16 nonresidential subcategories. Private nonresidential spending was down 0.1%, while public nonresidential construction spending was down 0.8% in August.

“The disparity between high contractor confidence and worrisome macroeconomic outcomes persists,” said ABC National Chief Economist Anirban Basu. “According to ABC’s Construction Confidence Index and Backlog Indicator, many contractors remain in expansion mode and expect to experience rising sales and profit margins going forward. Many also expect their employment levels to be higher in six months.

“But the nonresidential construction data indicate that consistent spending growth remains elusive,” said Basu. “Given the rising costs of project financing and delivering construction services, that is not surprising. Arguably, it is contractor confidence that is counterintuitive.

“Reconciling strong microeconomic perspective with weak macroeconomic outcomes involves looking at segment-specific data,” said Basu. “While some segments like office and lodging continue to struggle in the context of behavioral shifts wrought by the pandemic, other segments are showing significant momentum. This is especially apparent in certain public construction segments like water/sewer, highway/street and flood control.”

Press Release from Associated General Contractors of America: Construction Spending Slips In August With Steep Slide In Homebuilding, Mixed Results For Public And Private Nonresidential Categories

Construction Association Officials Say Demand for Housing and Developer-Financed Projects Getting Crushed by Rising Interest Rates, But Infrastructure, Power and Manufacturing Could Gain Steam Soon

WASHINGTON, Oct. 3—Total construction spending declined by 0.7 percent in August as spending on new houses turned sharply lower, while public and private nonresidential construction posted mixed results, according to an analysis the Associated General Contractors of America released today of federal spending data. Association officials said that rising interest rates were hurting demand for housing and many private-sector projects while the impacts of new federal funding for infrastructure, semiconductor plants and green energy facilities have yet to fully kick in.

“The construction market is in a transition that is likely to accelerate in the months ahead,” said Ken Simonson, the association’s chief economist. “Steeply rising interest rates have crushed demand for single-family housing and threaten developer-financed projects, while newly enacted federal legislation will soon boost investment in power, manufacturing, and infrastructure construction. But a pickup in these segments will require improvements in the timely approval of projects and adequate supplies of workers and materials.”

Construction spending, not adjusted for inflation, totaled $1.78 trillion at a seasonally adjusted annual rate in August, 0.7 percent below the upwardly revised July rate. Spending on new single-family homes declined for the fourth month in a row, falling by 2.9 percent from July. Spending on other residential segments rose, by 0.4 percent for multifamily construction and 1.0 percent for improvements to owner-occupied housing.

Private nonresidential spending edged down 0.1 percent for the month. The largest segment, power—comprising electric, oil, and gas projects—slipped 0.9 percent in August. Spending on commercial construction—warehouse, retail, and farm projects—was flat. Manufacturing construction declined by 0.5 percent in August but jumped 21.6 percent over 12 months. Spending on office construction, which includes data centers, climbed 0.3 percent for the month.

Public construction spending decreased by 0.8 percent in August, with declines for the three largest segments. Highway and street construction spending fell 1.4 percent, while educational and transportation construction spending each decreased 0.4 percent.

Association officials said the benefits of recent new federal investments in construction of infrastructure, manufacturing and energy production have been delayed by some of the regulatory requirements associated with the measures. They also cautioned that workforce shortages and ongoing supply chain problems could undermine the sector’s ability to deliver federally funded projects and help rebuild in parts of the southeast after Hurricane Ian.

“Federal officials can shore up slowing demand for construction by moving more quickly to fund new projects,” said Stephen E. Sandherr, the association’s chief executive officer. “Meanwhile, boosting investments in construction training and education programs will help ensure there are enough workers to rebuild after natural disasters and modernize our infrastructure and energy and manufacturing sectors.”