Key Takeaways

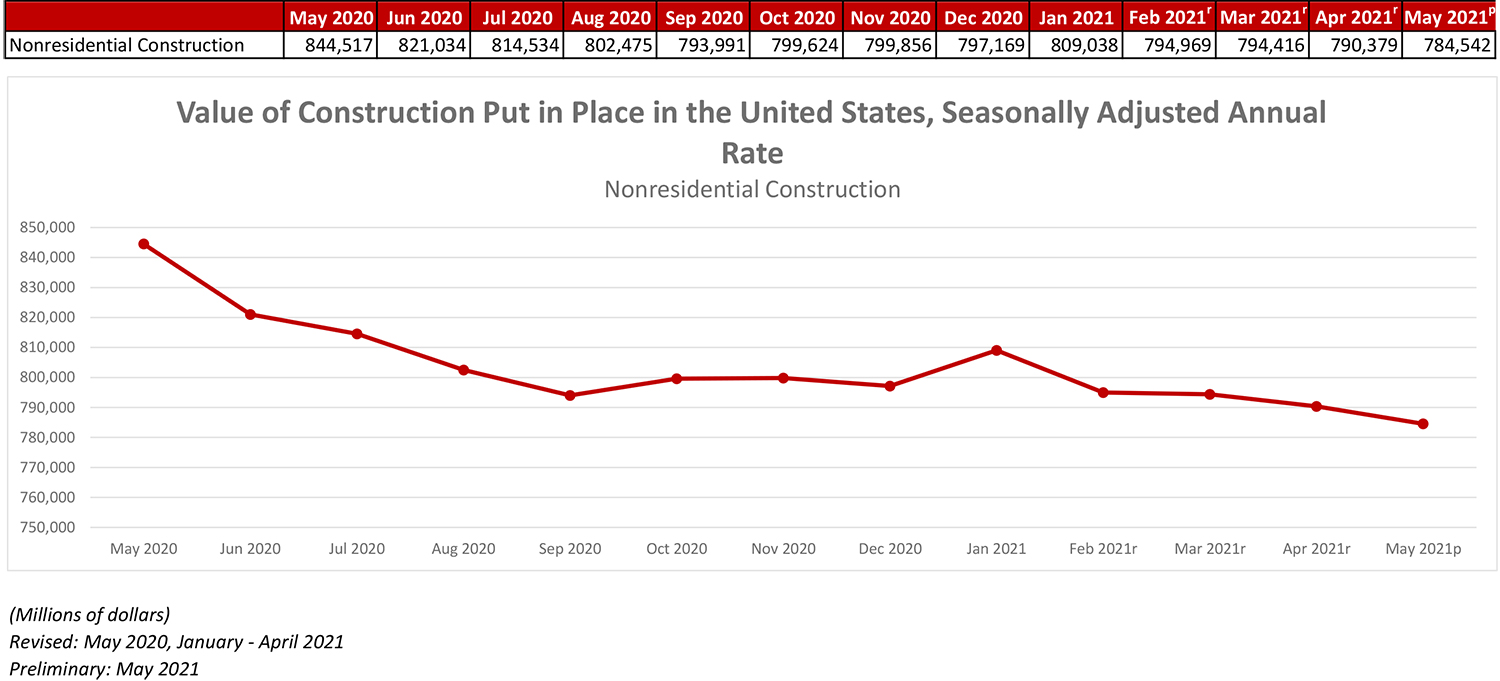

- National nonresidential construction spending declined 0.7% in May 2021.

- On a seasonally adjusted annualized basis, nonresidential spending totaled $784.5 billion for the month.

- “There is a significant gap between elevated levels of contractor confidence and still poor nonresidential construction industry outcomes,” said ABC Chief Economist Anirban Basu. “Recent months have seen declines in nonresidential construction spending and employment, but contractors continue to indicate upbeat assessments regarding near-term performance, according to ABC’s Construction Confidence Index."

Press Release from Associated Builders and Contractors, Inc.

WASHINGTON, July 1—National nonresidential construction spending declined 0.7% in May, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $784.5 billion for the month.

Spending fell on a monthly basis in 11 of the 16 nonresidential subcategories and is down in every category except sewage and waste disposal year over year. Private nonresidential spending fell 1.1% in May, while public nonresidential construction spending declined 0.3%. Nonresidential construction spending is down 7.1% on a year-over-year basis.

“There is a significant gap between elevated levels of contractor confidence and still poor nonresidential construction industry outcomes,” said ABC Chief Economist Anirban Basu. “Recent months have seen declines in nonresidential construction spending and employment, but contractors continue to indicate upbeat assessments regarding near-term performance, according to ABC’s Construction Confidence Index.

“Certain segments have experienced particularly large declines in activity,” said Basu. “Lodging-related construction declined nearly 3% in May and is down more than 23% on a year-ago basis. Despite the red-hot data center construction segment, spending in the office category is down nearly 9% on a year-over-year basis. Spending declines are even larger in the conservation/development, educational and religious categories. Spending in the public safety category, which surged during the earlier months of the pandemic, is down nearly 40% since May 2020.

“Interestingly, while a number of private construction segments are struggling under the dislocating impacts of the pandemic, public nonresidential construction has actually declined more rapidly than the private sector over the past year,” said Basu. “With many state and local governments experiencing much better financial conditions than anticipated a year ago, public construction spending can be expected to improve going forward. However, anticipated improvement may be delayed by the specter of still high construction materials prices, which may induce many project owners to postpone the onset of construction. Construction worker shortages are also deeply problematic, further exacerbating costs at a time of sluggish industry recovery. To put this into further perspective, at the onset of the crisis, residential construction comprised 41% of total construction spending. That proportion is now up to 49%.”

Press Release from Associated General Contractors of America, Inc.

Nonresidential Construction Spending Continues To Decline In May, Even Compared To The Early Pandemic, Amid Supply Chain & Labor Challenges

Construction Officials Urge Federal Officials to Allow Unemployment Supplements to Expire, Take Steps to address Supply-Chain Backups and Remove Tariffs on Key Materials so Firms can Perform More Work

Overall construction spending declined in May compared to the prior month, driven by continued drops in non-residential construction activity as firms struggle with supply chain disruptions, rising materials prices and labor shortages, according to an analysis of new federal construction spending data by the Associated General Contractors of America. Officials with the association called on the Biden administration to remove tariffs on key construction materials, allow unemployment supplements that are keeping people out of the workforce to expire and take steps to address supply chain backups.

“Many construction firms would likely be even busier if only they could find materials for their projects and workers for their teams,” said Stephen E. Sandherr, the association’s chief executive officer. “Ending a program that is basically paying people not to work will help, especially if the administration also removes tariffs that are driving prices up on key construction materials.”

Construction spending in May totaled $1.55 trillion at a seasonally adjusted annual rate, a decrease of 0.3 percent from the pace in April, but 7.5 percent higher than the pandemic-depressed rate in May 2020. As has been true for the past several months, residential construction saw year-over-year gains while non-residential construction spending lagged. The residential construction segment climbed 0.2 percent for the month and 28.2 percent year-over-year.

Private nonresidential construction spending fell 1.1 percent from April to May and 5.8 percent since May 2020, with year-over-year decreases in all 11 subsegments. The largest private nonresidential category, power construction, fell 1.2 percent year-over-year and 1.6 percent from April to May. Among the other large private nonresidential project types, commercial construction—comprising retail, warehouse and farm structures—retreated 2.6 percent year-over-year and 0.7 percent for the month. Manufacturing construction fell 3.2 percent from a year earlier and 2.7 percent from April. Office construction decreased 8.3 percent year-over-year but remained flat from April.

Public construction spending plunged 8.7 percent year-over-year and 0.2 percent for the month. Among the largest segments, highway and street construction declined 4.3 percent from a year earlier, although spending rose 1.4 percent for the month. Public educational construction decreased 14.2 percent year-over-year and 1.9 percent in May. Spending on transportation facilities fell 10.4 percent over 12 months and 1.9 percent in May.

Association officials noted that firms in states that have ended the unemployment supplements have experienced an increase in the number of workers looking for employment. They added that firms in other parts of the country are still struggling to find qualified workers to hire. In addition, supply chain backups and rising materials prices are also hurting the industry. In response, the association released the third edition of its Construction Inflation Alert to inform project owners and government officials about the threat to project completion dates and contractors’ financial health.

“Being able to find workers is important, but contractors also need materials delivered on time and at a reasonable cost, to be successful,” Sandherr said.