Key Takeaways

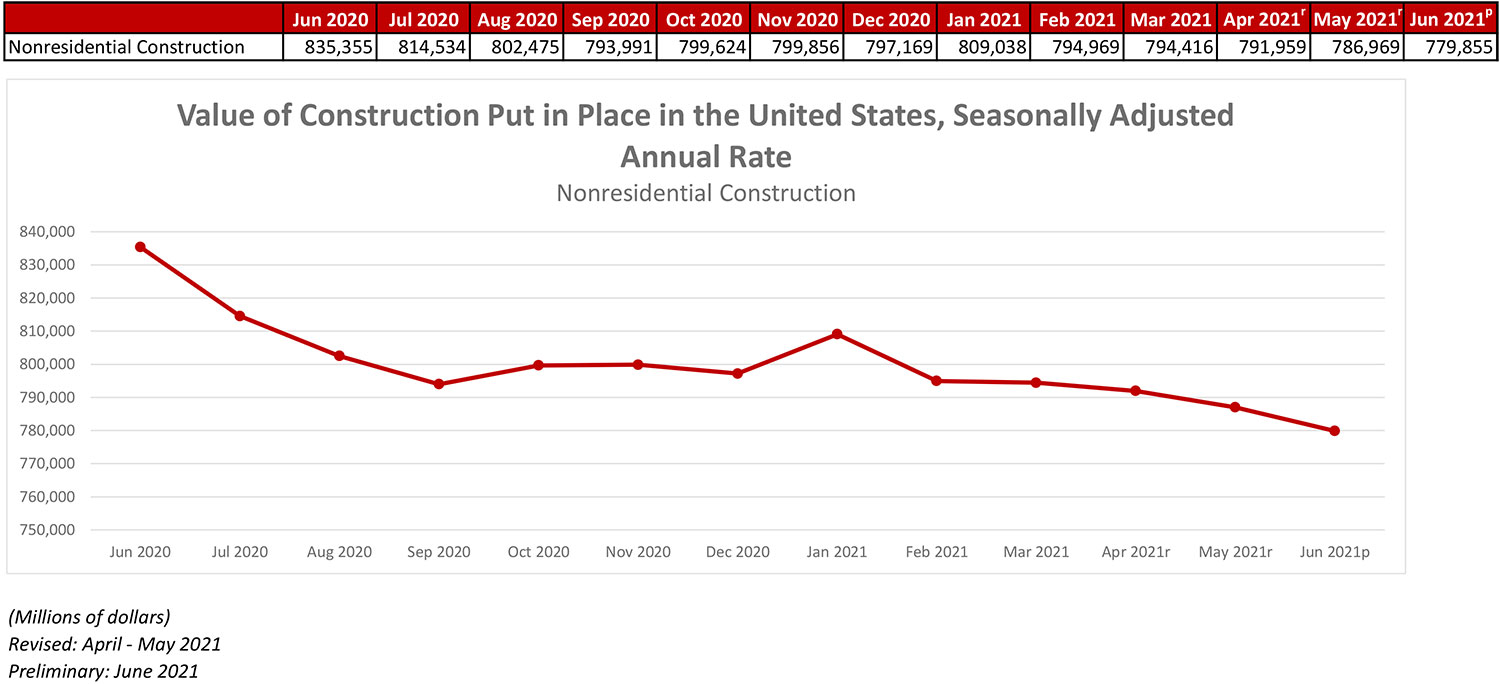

- National nonresidential construction spending declined 0.9% in June 2021.

- On a seasonally adjusted annualized basis, nonresidential spending totaled $779.9 billion for the month.

- “Despite the lingering pandemic and elevated materials prices, demand for construction services remains high. But this lofty demand is failing to translate into construction spending growth because available capacity to supply services is so constrained, especially by expanding skills shortages. This means the average project is taking longer to complete. It also translates into diminished construction spending on a monthly basis since less services are delivered."

Press Release from Associated Builders and Contractors, Inc.

WASHINGTON, August 2—National nonresidential construction spending declined 0.9% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $779.9 billion for the month, down 6.6% from one year ago..

Spending was down on a monthly basis in eight of 16 nonresidential subcategories. Private nonresidential construction spending fell 0.7%, while public nonresidential construction spending fell 1.2% in June. Year-over-year spending was down in 15 categories. Private nonresidential construction spending has declined 6% on a year-ago basis, while public spending is down 7.6%.

“Since achieving an all-time high in January 2020, nonresidential construction spending is down 12%,” said ABC Chief Economist Anirban Basu. “With each passing month, the deficit vis-à-vis the all-time high continues to expand. June was no exception, with both private and public nonresidential construction declining.

“For economists, this presents a bit of a paradox,” said Basu. “Many contractors report rising backlog and strong expectations for sales, staffing and profit margin growth over the balance of the year, according to ABC’s Construction Backlog Indicator and Construction Confidence Index. Yet the macroeconomic data continue to show an industry struggling to stabilize from the pandemic-induced recession.

“There is a logical explanation,” said Basu. “Despite the lingering pandemic and elevated materials prices, demand for construction services remains high. But this lofty demand is failing to translate into construction spending growth because available capacity to supply services is so constrained, especially by expanding skills shortages. This means the average project is taking longer to complete. It also translates into diminished construction spending on a monthly basis since less services are delivered. Consequently, individual firms generally remain confident about the future given the presence of demand for their services as well as rising backlog, but the macroeconomic outcomes remain uninspiring as quantity supplied struggles to match quantity demanded.”

Press Release from Associated General Contractors of America, Inc.

Nonresidential Construction Spending Falls Again In June, Driven By Big Drop In Funding For Highway & Street Construction, Other Public Work

Construction Officials Call for Swift Passage of the Bipartisan Infrastructure Bill, Noting the Measure Will Help Offset Continued Declines in Nonresidential Construction Activity and Create Sector Jobs

Demand for different types of construction continued to diverge in June as residential construction increased for the month and the year while nonresidential construction spending fell again, according to a new analysis of federal construction spending data the Associated General Contractors of America released today. Officials noted the nonresidential declines include a steep drop in spending on highway and street projects and urged Congress to quickly pass a new, bipartisan infrastructure measure.

“The pandemic has created a tale of two construction industries, a residential market where demand continues to surge and a nonresidential market that is struggling to gain traction,” said Stephen E. Sandherr, the association’s chief executive officer. “The federal government has a real opportunity to boost nonresidential construction by passing the bipartisan infrastructure measure as quickly as possible.”

Construction spending in June totaled $1.55 trillion at a seasonally adjusted annual rate, an increase of 0.1 percent from May, and 8.2 percent higher than the pandemic-depressed rate in June 2020. Once again, residential construction saw monthly and year-over-year gains while non-residential construction spending lagged. The residential construction segment climbed 1.1 percent for the month and 28.8 percent year-over-year. The nonresidential construction segment fell by 0.9 percent compared to May and 6.6 percent compared to June 2020.

Private nonresidential construction spending fell 0.7 percent from May to June and 6.0 percent since June 2020, with year-over-year decreases in all 11 subsegments. The largest private nonresidential category, power construction, fell 1.9 percent year-over-year and 1.2 percent from May to June. Among the other large private nonresidential project types, commercial construction—comprising retail, warehouse and farm structures—retreated 2.1 percent year-over-year and 0.2 percent for the month. Manufacturing construction fell 0.7 percent from a year earlier and 1.1 percent from May. Office construction decreased 9.1 percent year-over-year and by 0.1 percent compared to May.

Public construction spending plunged 7.5 percent year-over-year and 1.2 percent for the month. Among the largest segments, highway and street construction declined 7.6 percent from a year earlier and 5.3 percent compared to May 2021. Public educational construction decreased 9.1 percent year-over-year and 0.8 percent in June. Spending on transportation facilities fell 5.7 percent over 12 months but was up 1.1 percent in June.

Association officials said the new bipartisan infrastructure measure would invest more than $1.2 trillion to build the nation’s roads, bridges, transit systems, airports, ports, and waterways, drinking water and wastewater systems, energy infrastructure and more. They added that Congress should pass the measure as quickly as possible to have the broadest impact on creating new construction career opportunities.

“It would be a shame if certain members of Congress were to hold new infrastructure investments, and the job opportunities they create, hostage to impose unrelated partisan measures that would undermine the economic recovery,” Sandherr said.