Key Takeaways

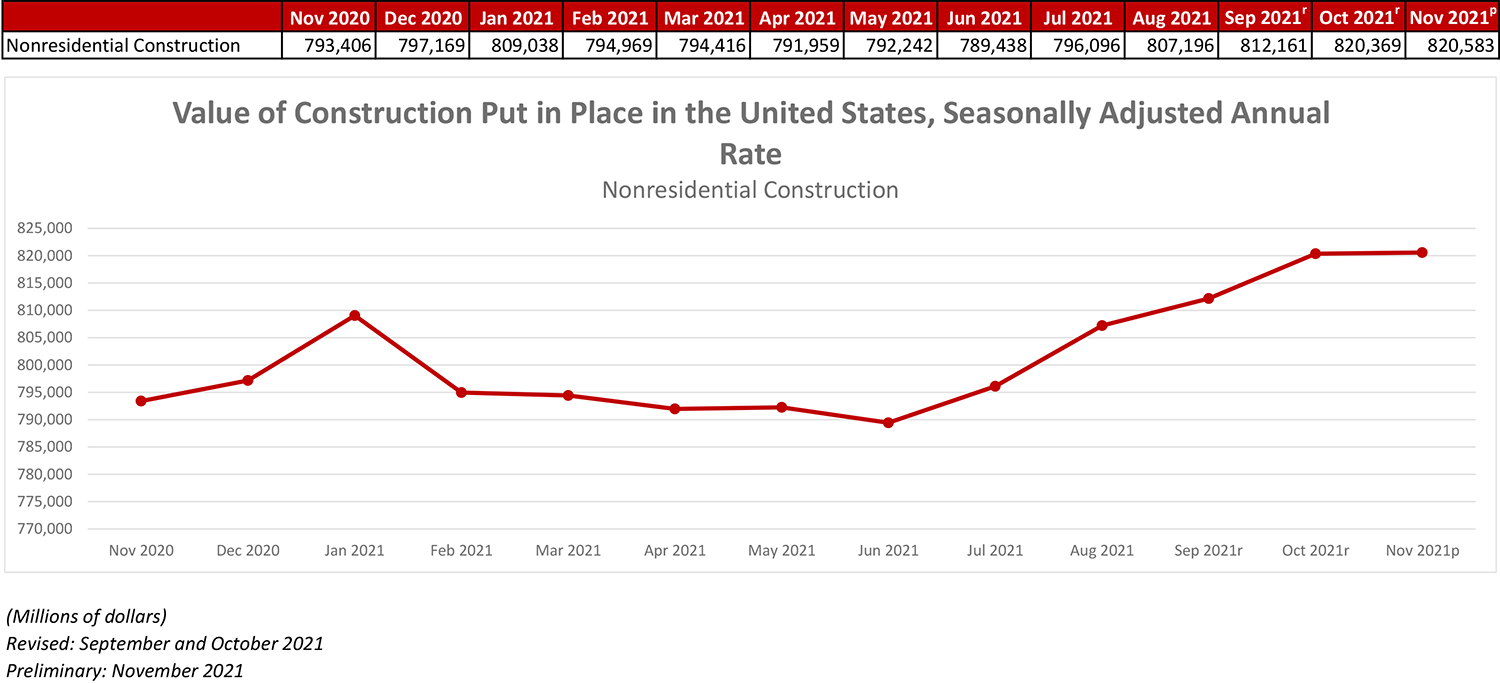

- National nonresidential construction spending in November was virtually unchanged from October.

- On a seasonally adjusted annualized basis, nonresidential spending totaled $820.6 billion for the month.

- "After declining during much of the pandemic, spending in the office segment has stabilized and is up 3.3% from a year ago. That may reflect data center construction spending more than traditional office space construction ... The nonresidential construction category experiencing the largest year-over-year growth in spending is manufacturing, a reflection of the ongoing efforts of producers to expand supply to meet demand."

Press Release from Associated Builders and Contractors, Inc.

WASHINGTON, Jan. 3—National nonresidential construction spending was virtually unchanged in November on a monthly basis, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $820.6 billion for the month.

Spending was up on a monthly basis in seven of the 16 nonresidential subcategories, with spending in the commercial and office subcategories unchanged. Private nonresidential spending was up 0.1%, while public nonresidential construction spending declined 0.1% in November.

“If no news is good news, then this was a fine report,” said ABC Chief Economist Anirban Basu. “There is little in the data for November 2021 that was earth-shattering. It is interesting to note, however, that the streak of meaningful monthly increases in nonresidential construction spending effectively ended in November, strongly suggesting that supply chain issues and worker shortages continue to constrain the pace of recovery in nonresidential construction (the same issues that continue to suppress contractor margins, according to ABC’s Construction Confidence Index).

“While the monthly data is overall not jarring, the year-over-year numbers are more noteworthy,” said Basu. “After declining during much of the pandemic, spending in the office segment has stabilized and is up 3.3% from a year ago. That may reflect data center construction spending more than traditional office space construction, however.

“Among all segments, the one experiencing the largest year-over-year decline is public safety,” said Basu. “During the pandemic’s early stages, spending in this category grew rapidly as America prepared for a public health crisis. That dynamic reversed itself in 2021. The other category suffering a major decline in construction spending over the past year is lodging.

With business travel still slow to return and the omicron variant wreaking havoc on airlines, occupancy will remain subpar for months to come, limiting the pace of construction spending recovery in this segment. The nonresidential construction category experiencing the largest year-over-year growth in spending is manufacturing, a reflection of the ongoing efforts of producers to expand supply to meet demand.”

Construction Spending In November Increases From October And Year Ago As Private Residential, Nonresidential Pickup Offsets Public Outlay Slide

Association Officials Call on Congress to Promptly Enact Funding to Fulfill Promises for Wide Range of Highway, Transportation and Other Public Sector Projects Included in Recent Bipartisan Infrastructure Bill

Press release from Associated General Contractors of America

Total construction spending increased in November compared to levels in October and a year earlier, as gains in private residential and nonresidential projects outweighed decreases in public outlays, according to a new analysis of federal construction spending data the Associated General Contractors of America released today. Officials noted that public sector investments were down in part because Congress has failed to provide funding so far for the Bipartisan Infrastructure bill enacted last year.

“Private nonresidential spending appears to be on a solid upswing, with five consecutive months of growth, but public outlays for construction remain erratic,” said Ken Simonson, the association’s chief economist. “The public side isn’t likely to post steady gains until funds from the new infrastructure law become available and turn into actual projects.”

Construction spending in November totaled $1.63 trillion at a seasonally adjusted annual rate, 0.4 percent above the October rate and 9.3 percent higher than in November 2020. Year-to-date spending in the first 11 months of 2021 combined increased 7.9 percent from the total for January-November 2020.

Private construction spending rose 0.6 percent in November from the October total and 12.5 percent from November 2020. In contrast, public construction spending slipped 0.2 percent for the month and 0.9 percent year-over-year.

There were gains in both residential and nonresidential private construction. Spending on new single- and multifamily residential projects, along with additions and renovations to existing houses, increased 0.9 percent for the month and 16.3 percent from a year earlier. Private nonresidential spending edged up 0.1 percent from October and 6.7 percent from November 2020. The largest private nonresidential segment, power construction, rose 0.1 percent for the month and 7.5 percent year-over-year. Among other large segments, commercial construction--comprising warehouse, retail, and farm structures--dipped 0.1 percent in November but jumped 15.1 percent year-over-year. Manufacturing construction increased for the 11th month in a row, by 0.9 percent, putting the total 22.4 percent above the year-earlier level.

The largest public categories posted mixed results. Highway and street construction slid 0.8 percent from October but rose 0.2 percent compared to November 2020. Educational construction climbed 0.3 percent for the month but declined 6.3 percent year-over-year. Transportation spending fell 0.5 percent in November but rose 0.7 percent from the year-earlier total.

Association officials said that public construction spending likely suffered from the fact Congress has not yet allocated the additional funds that were authorized in the Bipartisan Infrastructure bill that the President signed into law last year. As a result, the economic benefits from that measure will be delayed for at least a few months until Congress passes a new spending bill.

“Construction demand is definitely being impacted by Congress’ failure to include the funding increases it promised as part of the Bipartisan Infrastructure bill,” said Stephen E. Sandherr, the association’s chief executive officer.