Key Takeaways

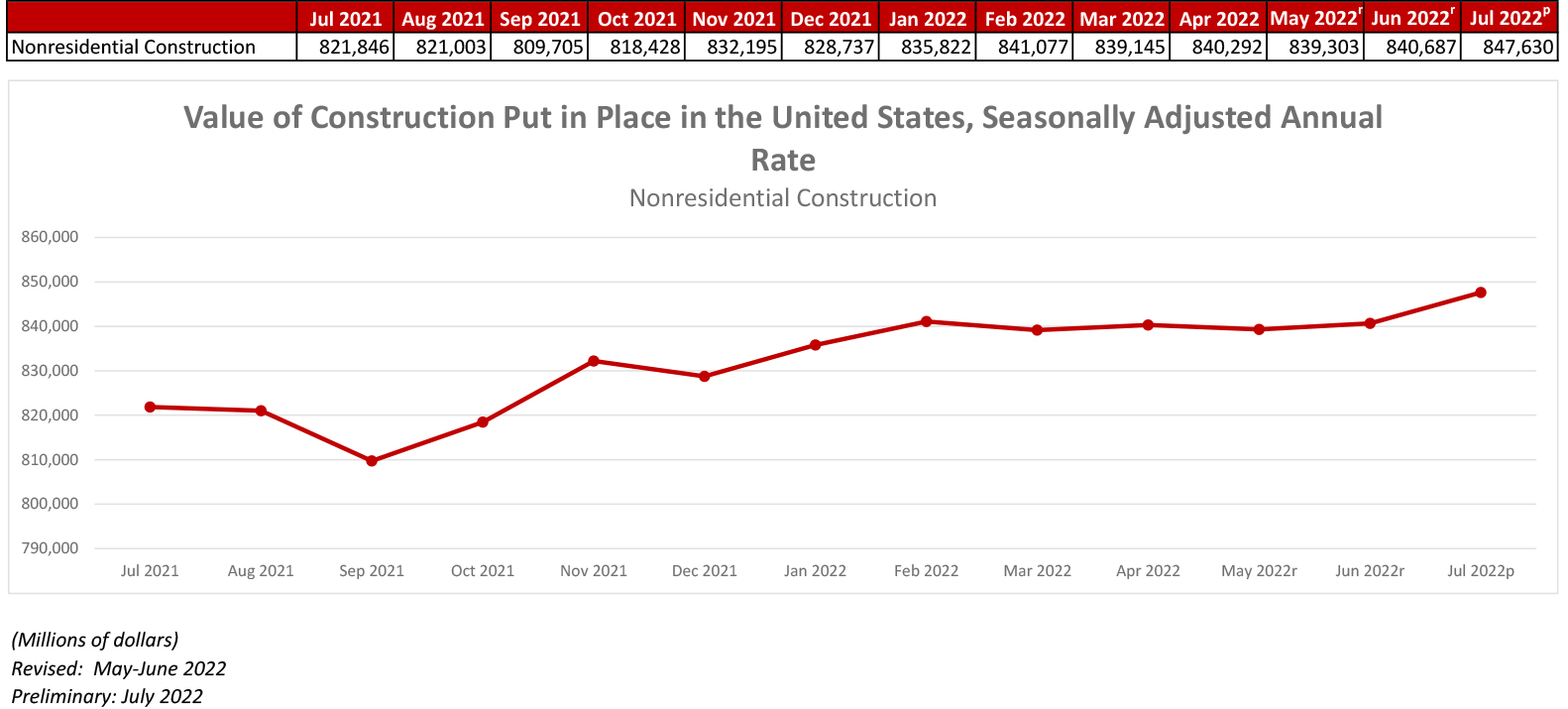

- National nonresidential construction spending increased 0.8% in July.

- On a seasonally adjusted annualized basis, nonresidential spending totaled $847.6 billion for the month.

- "There were gains for the month for nearly every private nonresidential category, along with a jump in highway and transportation work. But our survey found every type of contractor is facing challenges in finding enough qualified workers to meet the demand that is probably limiting total construction activity."

ABC: Nonresidential Construction Spending Increases by a Modest 0.8% in July

WASHINGTON, Sept. 1—National nonresidential construction spending increased 0.8% in July, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $847.6 billion for the month.

Spending was up on a monthly basis in 13 of the 16 nonresidential subcategories. Private nonresidential spending was up 0.4%, while public nonresidential construction spending was up 1.5% in July.

“The nonresidential sector continues to grapple with rising borrowing costs, elevated materials and labor costs and pervasive economic pessimism,” said ABC Chief Economist Anirban Basu. “Despite a modest increase in July, nonresidential construction spending remains below its pre-pandemic level. There is, however, at least one bright spot for the industry: publicly financed construction. State and local governments are flush with cash, and considerable funding is slated for various forms of infrastructure. In July, spending in the highway and street category increased 4.4%, while spending in the public safety category rose 2.3%.

"For privately financed construction, circumstances could get worse before they get better,” said Basu. “The Federal Reserve recently recommitted to further tightening monetary policy. Market sentiment quickly turned negative. Rather than disappear, supply chain challenges are proliferating in much of the world, including in Europe and China, and the risk of recession is elevated. This is simply not a set of circumstances conducive to rapid nonresidential construction spending growth, and according to the most recent Construction Confidence Index, just 31% of contractors expect their profit margins to grow over the next six months.”

Press Release from Associated General Contractors of America: Construction Spending Slips In July As Sharp Downturn In Homebuilding Outweighs Advances In Private Nonresidential And Public Projects

Construction Association Survey Finds Labor Shortages and Supply Chain Problems are Constraining Further Nonresidential Growth; Officials Urge Public Leaders to Reform Training and Immigration Policies

WASHINGTON, Sept. 1—Total construction spending decreased by 0.4 percent in July as spending on new houses and apartments tumbled, overshadowing a pickup in private nonresidential and public construction, according to an analysis the Associated General Contractors of America released today of federal spending data. Association officials said their newly released survey, conducted with Autodesk, showed labor shortages and supply chain problems are limiting their ability to complete projects, likely undermining total construction spending levels.

“There were gains for the month for nearly every private nonresidential category, along with a jump in highway and transportation work,” said Ken Simonson, the association’s chief economist. “But our survey found every type of contractor is facing challenges in finding enough qualified workers to meet the demand that is probably limiting total construction activity.”

Construction spending, not adjusted for inflation, totaled $1.78 trillion at a seasonally adjusted annual rate in July, 0.4 percent below the upwardly revised June rate but 8.5 percent higher than in July 2021. Private nonresidential construction spending rose for the third month in a row, increasing 0.4 percent from June. Public construction spending climbed 1.5 percent from June. However, these increases were negated by a 1.5 decline in private residential spending. That segment was dragged down by a 4.0 percent slide in new single-family spending and a dip of 0.6 percent in multifamily spending.

Ten of the 11 private nonresidential categories in the government’s release had at least minor upturns in July, Simonson noted. The largest private segment, commercial construction—warehouse, retail, and farm projects—increased 0.7 percent. Power construction, including spending on oil and gas projects, rose marginally. Manufacturing construction added 0.6 percent. Office construction spending, including data centers, climbed 0.6 percent.

The largest public category, highway and street construction, leaped 4.3 percent for the month. Other major segments were mixed: spending on education structures inched down 0.1 percent, while outlays for transportation facilities rose 1.4 percent.

The association’s survey found contractors broadly optimistic about demand for projects, Simonson said. Seventy-one percent of the firms expect to add employees in the next 12 months. But shortages of workers had caused projects to be delayed for 66 percent of the firms, and 82 percent had experienced delays due to shortages or longer lead times for acquiring materials.

Association officials said that labor shortages and supply chain problems are undermining total construction activity. These urged public leaders to boost funding for construction-focused education and training programs. These also called for immigration reform to allow more people with construction skills to lawfully enter the country.

“It is hard to build without builders,” said Simonson. “Getting more people exposed to construction is the surest way to expand the industry’s workforce and put more people into high-paying construction careers.”